Reed’s law states that the value of a network increases exponentially with each subgroup users can form within it, as opposed to Metcalfe’s Law, which states its worth is proportional to its user count squared.

Understanding Reed’s Law

Reed’s Law was proposed by David P. Reed in 1999 and states that network value increases exponentially with each potential subgroup that forms within it. More specifically, social networks scale exponentially with participant numbers due to subgroup formation.

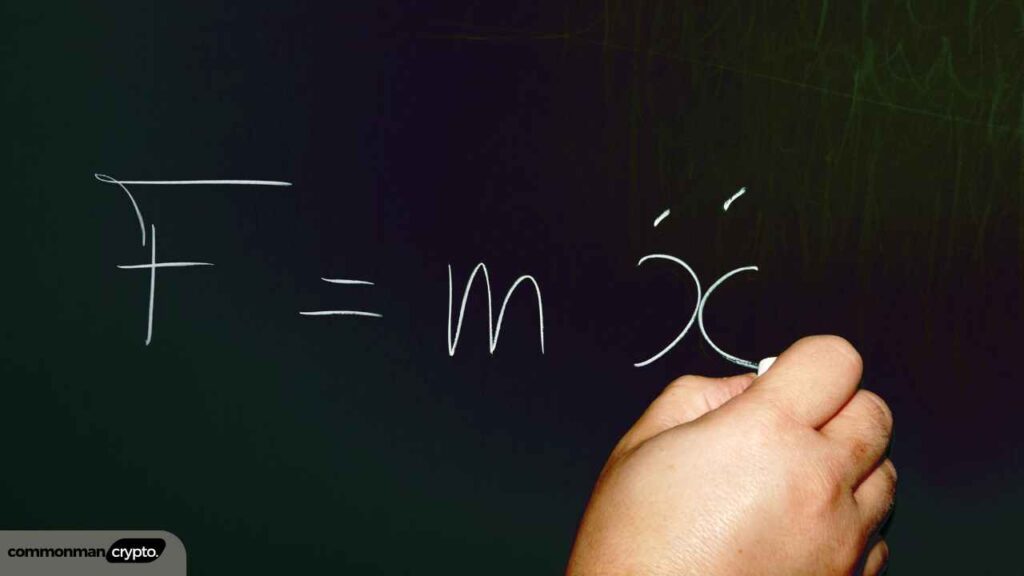

Reed’s Law can be expressed mathematically with this formula: 2N−N−1, N is the number of participants involved in a network.

Importance in the Crypto Space

Reed’s Law holds particular significance in relation to cryptocurrency and blockchain networks for several reasons:

- Exponential Growth in Value: Reed’s Law asserts that as more users join a network, their ability to form subgroups exponentially increases and thus exponentially boosts its value – this is particularly relevant for blockchain networks that thrive through user participation and community engagement.

- Fostering Innovation: Reed’s Law has predicted exponential growth that encourages the creation of decentralized applications (DApps) and other innovative solutions, like blockchain technology itself. As more specialized communities emerge around blockchain technology, these could become sources of user-centered solutions across industries like finance, gaming, healthcare, and governance.

- Decentralized Governance: Reed’s Law endorses decentralized governance models like Decentralized Autonomous Organizations (DAOs). DAOs benefit from having multiple subgroups who participate in decision-making processes and more inclusive and democratic structures for governance purposes.

- Challenges and Pitfalls: Applying Reed’s Law to crypto networks does present unique obstacles, including managing complex subgroups, assuring security and privacy, maintaining engagement, and long-term sustainability of exponential growth predicted by Reed’s Law, plus the risk of overestimating network value leading to market instability.

- Network Effects and Adoption: Reed’s Law and Metcalfe’s Law are two commonly cited examples of network effects in cryptocurrency. As more users join a cryptocurrency network, its value rises, which attracts even more participants and drives the growth and adoption of cryptocurrencies such as Bitcoin. These self-reinforcing cycles play a crucial role in driving their success and adoption.

How Reed’s Law impacts the growth and value of cryptocurrencies

Reed’s Law makes an indelible mark on cryptocurrency growth and value by emphasizing their exponential increase as communities and applications spread within cryptocurrency networks. It has had a tremendous effect on both.

Here is how Reed’s Law affects cryptocurrency:

Community Building and Adoption

Reed’s Law illustrates the vital importance of community participation in cryptocurrencies. According to it, as more people join a network, the number of potential communities and subgroups inside its ecosystem grows exponentially – something witnessed with Bitcoin (BTC) and Ether (ETH). Both cryptocurrencies have seen exponential growth within their respective communities, which has resulted in widespread adoption and value appreciation worldwide.

Decentralized applications (DApps)

Reed’s Law highlights the value of decentralized ecosystems. When DApps multiply exponentially on Ethereum’s network, their value increases exponentially as these applications multiply – thus reinforcing Reed’s Law assertion.

Niche and use case-specific cryptocurrencies

Reed’s Law applies when specific cryptocurrencies are developed for specific businesses or use cases, drawing together communities relevant to these uses. An example is Brave Browser’s Basic Attention Tokens (BAT), an altcoin intended to transform digital advertising. Users, advertisers, and content producers make up this BAT community, which increases its usefulness and value over time.

Role of Reed’s Law in shaping tokenomics strategies

Reed’s Law provides the framework for tokenomics initiatives by emphasizing its exponential growth potential through multiple subgroups and communities forming.

Reed’s Law plays an instrumental role in developing tokenomics strategies and planning and executing blockchain initiatives. Tokenomics – an economic model supporting cryptocurrencies – leverages this principle by encouraging use case development and encouraging active community interaction.

Reed’s Law recognizes the potential of exponential increases in project value as new communities and subgroups form, providing tokenomics techniques a means of capitalizing on this phenomenon by encouraging users and programmers alike to develop applications within an ecosystem, thus increasing overall usefulness and allure for those within. As more specialized subgroups form, demand for its native token increases, thereby positively impacting its value.

Reed’s Law illustrates how important it is to build relationships between subgroups. Interconnectedness contributes to a thriving ecosystem where its worth skyrockets through cooperative efforts, leading to dramatic gains for tokenomics models that promote community interactions that create network effects that ultimately increase project value.

Reed’s Law also highlights the value of community-led initiatives. Tokenomics strategies often set aside a portion of tokens for community development, encouraging various communities to form. These groups participate in governance processes, offer support, and develop apps to benefit the ecosystem – increasing resilience and sustainability over time while creating long-term benefits.

Potential pitfalls in applying Reed’s Law to crypto networks

Reed’s Law provides valuable insights into the development of cryptocurrency networks, yet when applied to cryptocurrency ecosystems, it poses unique challenges in terms of managing subgroups’ complexity, anticipating their success, keeping engagement high, managing expectations effectively, and assuring security and privacy. To properly implement Reed’s Law successfully.

One significant drawback of decentralized networks is managing multiple subgroups effectively. Coordinating interactions and creating an effortless user experience becomes more challenging as more communities join. To prevent division and conflicts among communities, robust governance systems may be necessary; this can prove difficult with decentralized networks.

Complexities arise when trying to predict which subgroups will gain traction, creating yet another barrier. A cryptocurrency network’s value may not always be distributed evenly among its communities; therefore, it’s often difficult and takes trial-and-error to identify which subgroups provide maximum benefits and sustainability, leading to wasteful use of resources.

Reed’s Law can be difficult to keep up over the long haul. Maintaining equal levels of connection and involvement between subgroups as the network expands can be challenging, which may result in activity stagnation or decline, which reduces its overall value proposition.

Of course, there’s always the risk of overestimating the potential worth of your network, particularly if its expansion deviates from initial forecasts. Unrealistic predictions may lead to disappointed consumers and investors and could wreak havoc with your market stability.

Resolving privacy and security concerns when working with many subgroups can present unique challenges. Ensuring user identities, data, transactions, and safety within these communities is of utmost importance; failing to do so could impede the growth potential predicted by Reed’s Law while diminishing network value significantly.

How will Reed’s Law shape the future of crypto space?

Reed’s Law promises to change the crypto industry by encouraging exponential growth via varied and interlinked communities, driving innovation, and democratizing finance and governance.

Reed’s Law emphasizes the exponential value created by diverse communities, which in turn promotes the proliferation of creative DApps and networks as blockchain technology progresses. This potential for exponential expansion fuels innovative solutions across the banking, gaming, healthcare, and government services industries.

Reed’s Law plays a vital role in supporting decentralized autonomous organizations (DAOs), nonfungible tokens (NFTs), and decentralized finance (DeFi). Furthermore, its application will have an effect on governance models by providing less centralization and more inclusive decision-making procedures.

As blockchain interoperability advances, connected communities will form synergistic networks, which will foster increased adoption and utility of cryptocurrencies. Reed’s Law will foster active crypto communities as well as decentralize finance, innovation, and governance to produce a decentralized future for the crypto industry.

You may also like:

GME Crypto stock soars 54% as ‘Roaring Kitty’, who drove meme craze comeback

5 Best Bitcoin Mixers and Tumblers in 2024

FBI Crypto Warning Against Unregistered Cryptocurrency Money Transmitting Services (2024)

In summary, Reed’s Law emphasizes the exponential value created by subgroup formation within a network, making it a fundamental concept in understanding cryptocurrency and blockchain networks. Furthermore, it stresses community engagement and decentralized governance while at the same time outlining any challenges that need to be met in order to unleash their full potential.