We are witnessing a major change in the cryptocurrency market as Ethereum is moving towards Bitcoin in terms of market capitalization.

Bitcoin ( BTC) and Ethereum ( ETH) are the two main principals of the cryptocurrency market, holding more than 70% of the total market capitalization.

Highlights

| Parameter | Details |

|---|---|

| Market Capitalization | – Bitcoin: $1 trillion as of February 26, 2021 – Ethereum: $370 billion |

| Institutional Acceptance | – Bitcoin: Large investments by MicroStrategy and Tesla, SEC approval of spot Bitcoin ETFs – Ethereum: Increasing adoption of decentralized apps, “The Merge” transition to proof-of-stake in 2022 |

| Historical Growth | – Bitcoin: Market cap grew from $1 million in 2011 to $1 billion in 2013, reaching $300 billion in 2017 and $1 trillion in 2021, then dropping to $320 billion by December 2022 |

| – Ethereum: Market cap grew from $60 million in 2015 to $73 billion in 2017, reducing the market cap gap with Bitcoin to 3.25:1 | |

| Market Dominance | – Bitcoin dominance initially over 90%, fell below 45% in December 2017, further reduced to around 2:1 in December 2021 |

| – February 25, 2023: Bitcoin’s market cap at $960 billion, Ethereum’s at $483 billion, ratio around 2.75:1 | |

| Technological Contributions | – Bitcoin: Introduction of spot Bitcoin ETFs, rapid ecosystem growth with platforms like STX blockchain and Ordinals, increasing use in Emerging and Developing Economies (EMDEs) |

| – Ethereum: Leading platform for decentralized finance (DeFi), NFTs, tokenization of real-world assets, with significant growth in TVL and adoption of smart contracts | |

| Future Projections | – Bitcoin: Positive scenarios include Bitcoin halving in April 2024, continued institutional acceptance, SEC approval of ETFs |

| – Ethereum: Potential for higher market cap due to broad utility, increasing DeFi and NFT adoption, and tokenization of assets, with potential market cap projections of $20 trillion by 2030 according to Ark Invest | |

| Utility and Innovation | – Bitcoin: Digital gold, expanding use cases including intelligent contracts, DeFi applications, NFTs, and cross-border transactions |

| – Ethereum: Digital oil, central to DeFi protocols, leading in NFT development and trading, tokenization of assets, and comprehensive smart contract capabilities | |

| Market Sentiment | – Speculation about “the flippening” where Ethereum’s market cap could surpass Bitcoin’s |

| Expert Opinions | – Goldman Sachs: Highlights Ethereum’s “real use potential” – Jim Cramer: Emphasizes Ethereum’s use for NFTs and digital assets – Cathie Wood: Projects Ethereum’s market cap to $20 trillion by 2030, Bitcoin price to reach $1 million |

| Coexistence and Future Outlook | – Both Bitcoin and Ethereum expected to coexist and prosper, each serving unique roles in the cryptocurrency market |

| Key Events and Milestones | – Bitcoin: Market cap peaks and subsequent declines, institutional endorsements, introduction of spot ETFs |

| – Ethereum: Transition to proof-of-stake, significant growth driven by ICOs, DeFi, and NFT booms | |

| Indicators of Market Dynamics | – Bitcoin dominance as a key indicator of market dynamics, evolving over time with the rise of altcoins and Ethereum |

In the course of time, Bitcoin evolved from a new concept into a worldwide financial asset and is now gaining acceptance in the eyes of institutions; the market cap was more than $1 trillion.

Companies such as MicroStrategy or Tesla have amassed large Bitcoin investments, which has boosted the popularity of Bitcoin. In addition, the recent endorsement of the spot Bitcoin Exchange-traded fund ( ETFs) by the U.S. Securities and Exchange Commission ( SEC) indicates increasing institutional acceptance.

Contrary to this, Ethereum emerges as the second-largest, having a market cap of around $370 billion. Its technology, known as blockchain technology, is the foundation of a wide set of decentralized apps.

Furthermore, the transition of the platform to a consensus mechanism based on proof-of-stake by the name of “The Merge” in 2022 was a significant technological breakthrough that aimed to address scalability as well as energy consumption security issues.

For a long time, a large portion of the crypto community has thought about a possible event dubbed “the flipping,” where Ethereum’s market capitalization could be higher than Bitcoin’s. Could Ethereum surpass Bitcoin in the long term?

BTC vs. Ethereum Market caps and dominance

Since its launch back in the year 2009, Bitcoin has been able to maintain its place as the top cryptocurrency, dominating the market, with a huge market capitalization that has surpassed its rivals until now.

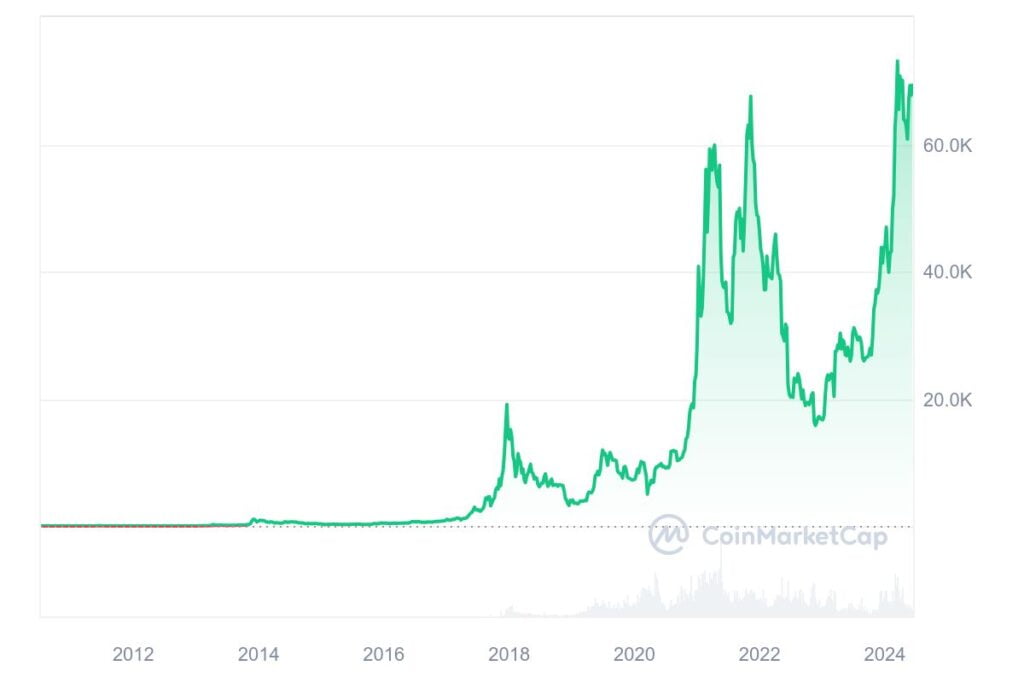

In the beginning, the market cap of Bitcoin was only $1 million at the time of its launch in 2011; however, by 2013, it had risen to $1 billion, which was an incredible 1000x boost. In the year 2013, the market cap of Bitcoin had reached $9 billion.

The year 2017 was a pivotal year for Bitcoin as it saw its market value rise to $300 billion for the very first time. This growth was driven by a large-scale retail and institutional investing frenzy, as well as an increasing interest in cryptocurrency as an exciting asset class.

However, this astronomical growth was not without challenges in November. In 2021, the market cap had surpassed 1 trillion dollars, but it would fall to $320 billion by the end of December. 2022.

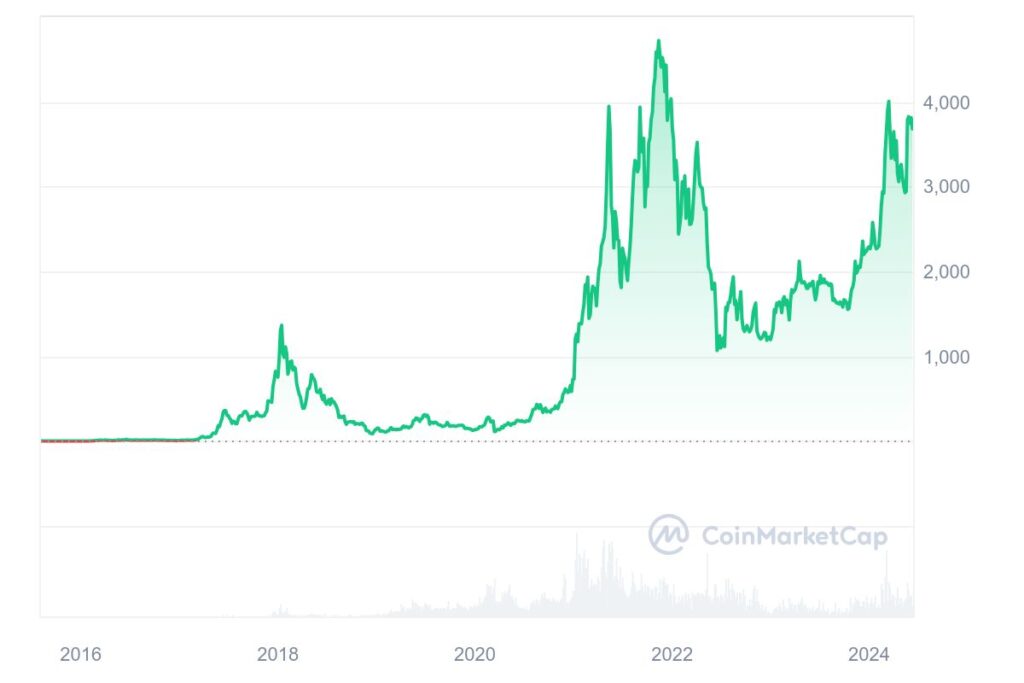

Contrarily, Ethereum embarked on a slower pace. However, it had a modest start following its debut in 2015. Ethereum rapidly established itself as one of the top five cryptocurrencies according to market capitalization.

In December. 2015, when Bitcoin’s market capitalization was more than six billion dollars, Ethereum’s value was just $60 million, which is an astounding difference of 100 times.

Then, the emergence of initial coin offerings (ICOs) in 2017 and the subsequent decline, as well as the NFT booms, helped propel Ethereum’s rapid growth.

In the month of December. 2017, the market cap of Ethereum was up to $73 billion, up from $60 million in December. 2015, which is an astonishing 1210x improve. This boost significantly reduced the gap of Bitcoin and Ethereum’s market cap to 3.25:1.

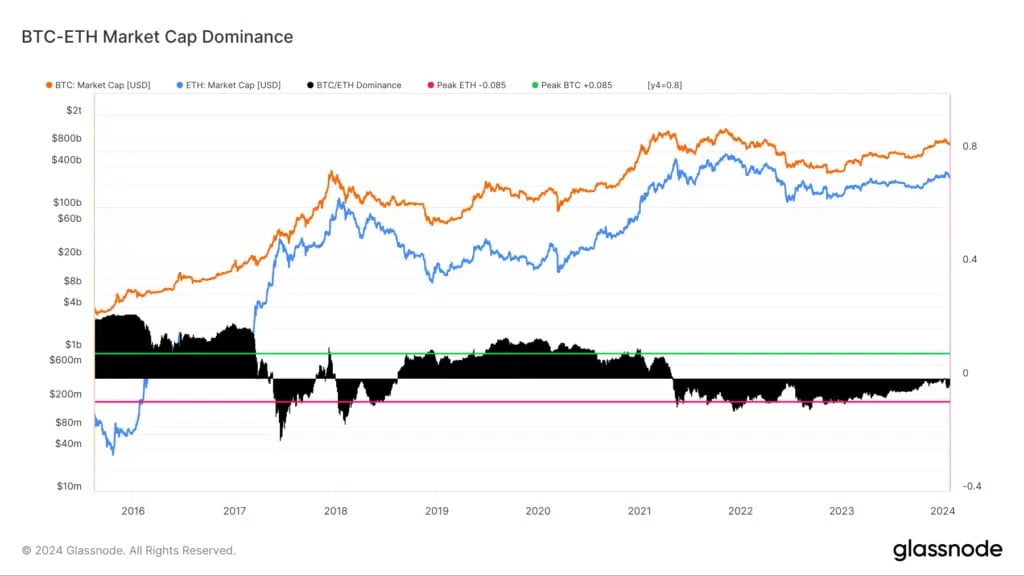

In parallel, the notion of “Bitcoin dominance” – Bitcoin’s market capitalization as a percentage of the market for all cryptocurrency has emerged as an important indicator of the dynamics in the crypto market.

At first, it was over 90%. Bitcoin’s dominance decreased to below 45% in December. 2017, altcoins led by Ethereum and Bitcoin gained momentum. In the end, this ratio was further slashed to around 2:1 in December. In 2021, the market value of Bitcoin was $960 billion, and Ethereum’s market cap was $483 billion.

As of February. 25, the ratio stood at around 2.75:1. There are several positive scenarios for Bitcoin, such as the expectation of Bitcoin reduction to half in April. 2024, and the approval by the SEC of the spot BTC ETFs in January. 2024, which could tip the balance in Bitcoin’s favor in the near term.

Contributions from the real world to Bitcoin, along with Ethereum

The advantages of Bitcoin, as well as Ethereum, to the crypto world have been becoming increasingly distinct, each creating distinct use cases as well as driving innovations in various directions.

Bitcoin’s growing ecosystem

Bitcoin has seen rapid growth in its ecosystem, especially since the advent of new platforms and technologies.

The introduction of the spot Bitcoin ETFs in January. 2024 is likely to have a significant impact, not only in improving the accessibility and appeal of Bitcoin but also in strengthening its role in global finance.

Trust Machines reported the “explosive growth in Bitcoin use cases” in the first quarter of 2023. The report also highlighted the growing interest of developers in building on top of Bitcoin.

This increase is due to it being a result of the STX (STX) blockchain, which allows intelligent contracts and defi-based applications, NFTs, and applications directly on Bitcoin, which expands its capabilities beyond being an asset store.

Alongside this, Ordinals, which were introduced in Jan. 2023, have provided an additional aspect to the use of Bitcoin by allowing data to be directly attached to satoshis individually through the process known as “inscribing.”

This breakthrough has led to the creation of Bitcoin-native NFTs, representing a major advancement in Bitcoin’s capabilities beyond its original purpose as an electronic currency.

In addition, the ECB’s work document emphasizes the significant use of Bitcoin within Emerging and Developing Economies (EMDEs), in which it is used not just as an investment feature but as an investment hedge against currency appreciation and as a way to facilitate transborder transactions.

The new ECB paper provides evidence that bitcoin is valued as a currency store and exchange tool in countries with high inflation.

Is the ECB the language used to describe #Bitcoin changing?

Almost exactly a year ago, when the #btc price was $20k, the ECB blog featured an article… pic.twitter.com/1kJYrRLXqz

— Patrick Hansen (@paddi_hansen) December 5, 2023

Ethereum’s numerous utility

Ethereum, on its own, is a leader in facilitating a broad range of defi platforms, apps, NFTs, and more due to its built-in smart contracting capabilities.

Although it is true that the advent of Ordinals and the capability to create NFTs directly through the Bitcoin blockchain is an important development, Ethereum continues to hold an edge in the NFT area.

The established standards of Ethereum, such as ERC-721 and Ethscriptions, have made it the most popular platform for NFT development and trading, which makes it a much simpler procedure than Bitcoin’s more recent entry into the market.

Furthermore, Ethereum is the backbone of the defi industry, which facilitates lending, borrowing, and trading using permissionless financial services. As per DefiLIama, as of February. 26 Ethereum has a value secured (TVL) of approximately $48 billion. This is the most of all the chains.

Ethereum has also become known as the most popular cryptocurrency for tokenizing real-world assets. This is the process of converting rights associated with an asset into a digital token that is stored on Ethereum. Ethereum blockchain, which increases the accessibility and liquidity of different kinds of assets. Citi has forecasted that tokenization could be an industry worth $4 trillion in 2030.

Could Ethereum surpass Bitcoin in the long term?

While Bitcoin is frequently thought of as digital gold, being a safe store in value, Ethereum can be compared to oil in the digital world, enabling many different applications that go beyond simple financial transactions.

Goldman Sachs, in a 2021 analysis, highlighted Ethereum’s significant “real use potential” due to its central role in running applications, such as Defi protocols.

The utility, like Goldman, places Ethereum as a possibility to surpass Bitcoin’s worth in the near future. But it’s worth noting that Goldman’s predictions have some naysayers and a smidgen of doubt to these forecasts.

In addition, Jim Cramer of “Mad Money” has also put his weight on Ethereum and its widespread use for purchasing NFTs as well as various other digital assets, which are the reason for its potential superiority over Bitcoin.

Cathie Wood of Ark Invest Ark Invest envisions a future in which Ethereum has a market capitalization that will be $20 trillion in 2030. She also predicted that Bitcoin’s price would be $1 million.

These forecasts show that Ethereum’s utility broad could alter its place in relation to Bitcoin.

In parallel, the notion of “Bitcoin dominance” – Bitcoin’s market capitalization as a percentage of the market for all cryptocurrency has emerged as an important indicator of the dynamics in the crypto market.

At first, it was over 90%. Bitcoin’s dominance decreased to below 45% in December. 2017, altcoins led by Ethereum and Bitcoin gained momentum. In the end, this ratio was further slashed to around 2:1 in December. In 2021, the market value of Bitcoin was $960 billion, and Ethereum’s market cap was $483 billion.

As of February 25, the ratio stood at around 2.75:1. There are several positive scenarios for Bitcoin, such as the expectation of Bitcoin reduction to half in April. 2024, and the approval by the SEC of the spot BTC ETFs in January. 2024, which could tip the balance in Bitcoin’s favor in the near term.

The road ahead

Although speculations regarding “the flippening” persist, the fact is that Bitcoin and Ethereum will likely be able to coexist and prosper with each having their own purpose within the wider cryptocurrency market.

The possibility for Ethereum to surpass Bitcoin in market capitalization highlights its wide-ranging use and the increasing demand for its technology.

However, its long-standing status as a digital gold currency and its expanding applications assure its effectiveness and durability.

As we progress in the future, it’s crucial to be aware of how these platforms respond to new challenges and opportunities as they seek to reimagine commerce and money in the age of digital.