Bitcoin price is outpacing Mt. Gox worries due to positive macroeconomic conditions, but certain analysts predict a fall below $50,000 over the next few weeks.

Bitcoin (BTC) was shaken by a series of events that were not favorable, including Mt. Gox’s current 140,000 BTC payment to its creditors as well as the German government’s constant BTC liquidations. These two factors could lead to the possibility of billions of BTC sales and have left traders asking if there are further negatives to the Bitcoin market following its 15% decline at the beginning of July.

Bitcoin will plummet to below $38,000, according to an analyst.

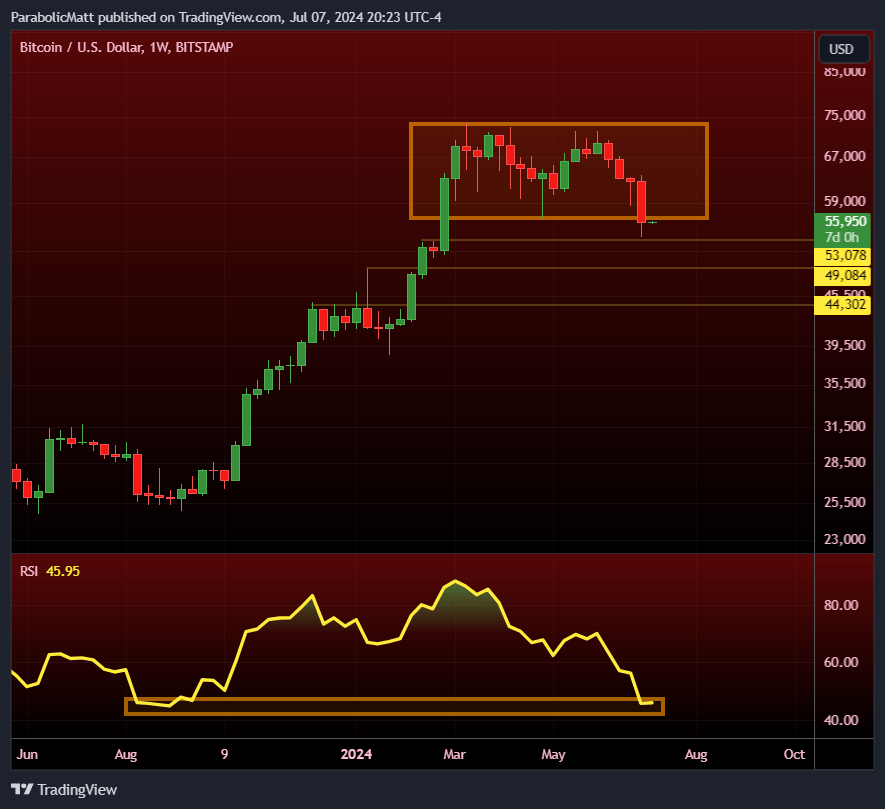

Market analyst Matthew Hyland has confirmed his price target for the downside of Bitcoin to be lower than $38,000.

In his X-post on July 8, Hyland cited Bitcoin’s break-up from a multi-month condensing range of the daily chart to back his bearish outlook. He also noted that the likelihood of Bitcoin being back within that same area is very low.

The bearish perspective was further emphasized through Bitcoin’s relative strength index (RSI) reading of approximately 45.

This RSI level indicates that neither sellers nor buyers are in charge. However, the current downward trend indicates that the RSI can be more prone to decrease, if only until it crosses the threshold of 30 oversold, which is usually the first sign of a price rebound.

In the same way, Bitcoin could continue dropping until the RSI gets to the oversold level of 30, which could coincide with Hyland’s target for a downside of less than $38,000.

The weekly RSI has nearly pulled back to the August/September lows of last year when BTC was trading at 25k,” Hyland was reminded of and added:

“Another red weekly candle would likely push the RSI lower which would then give opportunity for Bullish Divergence”

Could $50K be the next Bitcoin bottom?

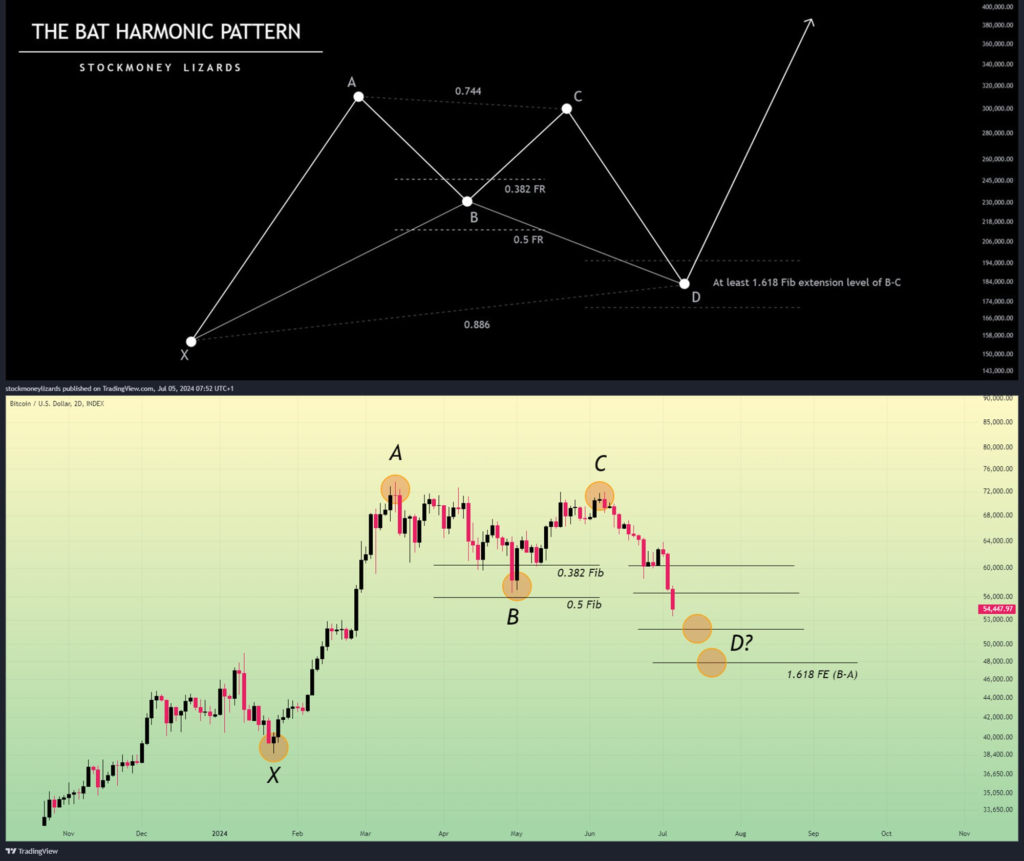

The pseudonymous analyst of the market Stockmoney Lizards, too, believes in another Bitcoin price decline. However, his target for the downside is around $50,000.

The chartist is citing a so-called “Bat Harmonic” pattern behind his sluggish bearish bias. The pattern begins with an initial price movement (XA) that is then the rectangulation (AB) and a second move (BC) followed by an end-of-leg (CD) that stretches to 88.6 percent from what was the XA leg.

This is the crucial region where traders are expecting an inverse trend, which is often supported by more indicators like pattern patterns on candles or even volume. In the case of Bitcoin, point D is aligned with the level of $50,000, after which the price could experience an explosive rebound.

“We are waiting for another liquidity flush, potentially with a long wick below 50k to establish 52k support,” Stockmoney Lizards explains, saying:

“Daily RSI etc are already oversold, however, we believe there is still some more downside. Ideally we consolidate at 52k, forming a bullish divergence with high volume which would be the reversal signal for us.”

Prospects for macroeconomics for BTC price

Positive economic data coming from the United States, particularly increased Wall Street bets on a possibility of a cut in interest rates in September, helped ease Bitcoin’s negative outlook in the ongoing correction.

As of July 8, the traders who trade in futures rate have increased their expectations of the rate to be reduced in September to 67.3 percent, which is up from 46.6 percent a month earlier, like to CME. The shift towards a more cautious outlook took off following the disappointing U.S. jobs data published on June 5 that led to the sharp drop in the short-term yields.

Lower yields lower the for holding more secure investments like U.S. bonds. They also increase the demand for riskier assets such as the stock market and cryptocurrency. Last week’s closing, on June 5 on June 5, it was reported that the S&P 500 and Nasdaq indexes reached record highs.

Bitcoin has also caught up to the market trend and reversed its Mt. Gox, German government-led losses. The price has increased by 77% from its previous lowest of $53,550, which was established in June. These gains correspond with the $398 million worth of daily inflows into Bitcoin-based investment funds. This includes Exchange-traded Funds (ETF).

“Digital asset investment products saw inflows totalling US$441 million, with recent price weakness prompted by Mt Gox and the German Government selling pressure likely being seen as a buying opportunity,” says James Butterfill, a researcher at the asset management company CoinShares.

The positive macroeconomic catalysts and the inflows of Bitcoin-related funds are creating positive technical conditions. In particular, BTC is currently testing its multi-month ascending trendline resistance and is looking for a dramatic rise toward its multi-month horizontal trendline resistance of $71,500 in the third quarter of 2024.

In contrast, a fall below the trendline’s ascending support is a risk of crashing the price toward its 0.786 Fibonacci retracement level at approximately $51,500. This is close to the Stockmoney Lizards’ analysis discussed earlier.