In addition, Polymarket traders doubt Trump will face prison time; Kalshi bettors are in contradiction against those who support the CME FedWatch poll on rate reductions.

- Trump is found guilty; however, gamblers on Polymarket have a chance to win a conviction, and Trump will remain out of jail and be back in his White House.

- This year, there is no rate cut, Kalshi traders say

Donald J. Trump is the first U.S. president, former or not, who has been found guilty in a criminal trial. However, this ambiguous distinction didn’t change his chances of retaking his place in the White House, prediction markets suggest.

For those who aren’t familiar for those who are not familiar with predictions markets, once the trade is settled, the bettors who bet on the correct outcome receive one dollar per contract, while those who purchased “shares” in the incorrect one will receive zero. The value of the contract can be interpreted in the same way as the payoff of a poll. A contract that has a value of 40 cents could be interpreted in terms of a 40% probability of the prediction being to pass.

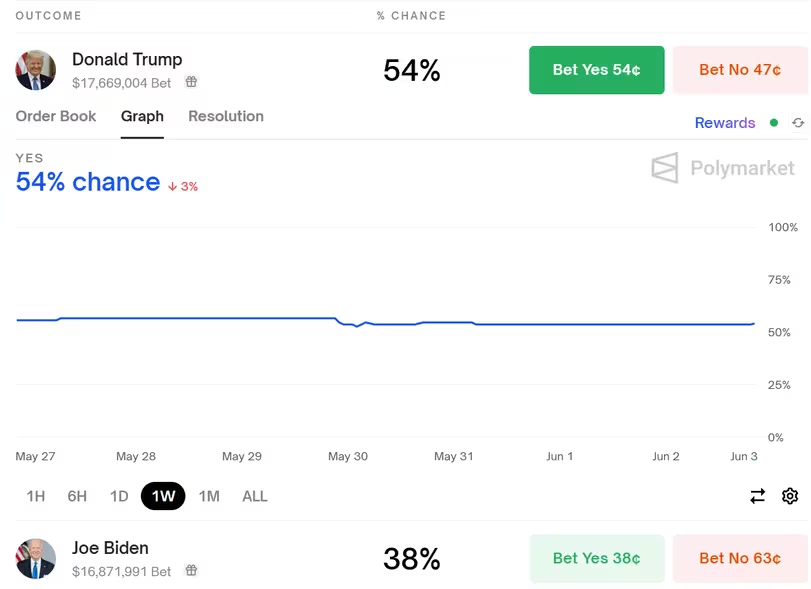

On the crypto-based Polymarket, which is in which an election contract stands a little over 150 million in bets, the verdict of Trump’s guilt did little to change prices, only knocking one cent from that “yes” contract’s value.

The odds of Trump winning are dropping by two percentage points to 54 percent. On May 31, when a jury found Trump guilty of felony offenses, the jury lost just one percent.

Trump’s advantage of 16 points over President Joe Biden on Polymarket is significantly more prominent over the average survey results. Based on the traditional measurement, the presumed GOP candidate is ahead of Biden’s incumbent, but not by more than one percent, which is adequate for the average of 270 to win.

On PredictIt, a more popular betting site, where trades are executed in dollars, not stablecoins and stablecoins, the Trump contract grew by 1 cent after the guilty verdict, though his lead at 51-48 over Biden is smaller and more in line with the polls than Polymarket. Contrary to Polymarket, which blocks U.S. users under a regulatory settlement but allows traders across the globe, PredictIt is open only to Americans.

Legal experts have suggested that Trump is not likely to receive a prison sentence for the crime he committed, and the market is aligned with this view.

On the back of a Polymarket agreement asking whether Trump will be sent to prison, the bettors are certain that he will not be inside of a cell with a 76% chance the prisoner will not be sentenced and a change of 18% the chance of serving less than a year with a change of 2%, could mean he’ll get anywhere from one to two years.

Polymarket bettors were pretty precise in predicting the sentence given to the former Binance Chief Executive Officer Changpeng “CZ” Zhao.

CZ was convicted (and is currently serving) to a four-month sentence in prison. Before the sentencing date, the market was certain that CZ would be sentenced to less than one year, specifically less than six months. The Department of Justice had asked for a sentence of three years, and CZ’s attorneys had advocated on behalf of 18 months as part of his plea deal.

Rate cut to a new low?

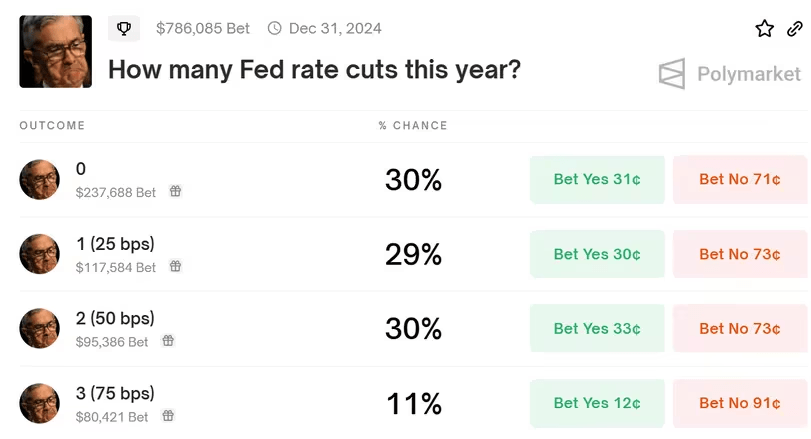

Kalshi, along with the Polymarket traders, aren’t anticipating cuts in rates, resulting in a stark contrast to that of the CME FedWatch poll, which predicts an improvement in rates by the end of fall and offers some assurance of another cut before the winter.

On Kalshi, which is the only U.S.-regulated platform that offers contracts, traders offer a 32% probability of no cuts, whereas they quote the possibility of one cut. “Two cuts” is coming next, at 24%.

In Polymarket, Bettors are divided between two and zero cuts, which gives an average of 30% for each event happening.

Economics experts are divided over whether or not the Federal Reserve will lower interest rates by 2024.

Factors such as a rising rate of inflation, a robust economy, and a strong labour force, even though slightly softening, suggest that ease in monetary policy might not be needed. But, the persistence of this pattern throughout the entire year creates some uncertainty.

Some, such as Steve Englander from Standard Chartered Bank, argue there’s a chance of cuts in July with a focus on possible decreases in the core rate of inflation as well as the effects of seasonality on the current inflation figures.

A report from the CME’s FedWatch poll, the market’s participants’ poll, provides a different picture.

It’s looking at an average 54% probability that the initial rate cut will take place before the Sept. 18 meeting of the Federal Open Market Committee and increasing confidence that a subsequent – or even a third cut will be announced by December.

This divergence is something to keep an eye on to determine whether the market users on CME’s FedWatch are more knowledgeable than market participants on market predictions.