Venmo is a flexible financial app that offers many options, such as peer-to-peer (P2P) money transfers as well as cryptocurrency transactions. As a complete tool for financial transactions, Venmo enables users to easily manage transactions and offers the opportunity to take part in digital currencies such as Bitcoin ( BTC). It is designed to make transactions in the financial sector easier and help users navigate modern economic systems.

What is Venmo?

Venmo the mobile payment platform that was launched in 2009, is under the ownership of PayPal since. It is an online platform for payments within the United States. Social payment apps facilitate transactions between customers as well as businesses. It also functions as an digital wallet that allows users to build up funds in their Venmo accounts to cover future expenditures.

Venmo is also able to expand the capabilities of its app by including cryptocurrency-related transactions permitting users to purchase or sell digital assets inside the application. In line with a similar move of its owner, PayPal, the feature was announced at the beginning of April 2021. Venmo customers who reside in the U.S., excluding Hawaii, are able to use four different cryptocurrencies: BTC, Ether ( ETH), Litecoin ( LTC) and Bitcoin Cash ( BCH). In the near future, Venmo has plans to include PayPal USD stablecoin (PYUSD). Paypal USD stabilized coin ( PYUSD).

Buy Bitcoin using Venmo

To buy Bitcoin through Venmo, customers can make use of their Venmo balance bank account, debit card, and other payment options. However, it is crucial to keep in mind that credit cards, as well as Venmo Credit Cards, are not available for these transactions. Additionally, customers are prohibited from purchasing crypto through Venmo. Users are only allowed to make purchases up to a weekly limit of $20,000 as well as a yearly limit of $50,000 for the purchase of crypto.

Because cryptocurrencies are digital currencies, purchasing them requires the exchange of one currency to another. The exchange rate is the basis for the amount of Bitcoin users get as a payment in U.S. dollars. Remember that the values of cryptocurrency are extremely unstable and fluctuate frequently.

How to buy Bitcoin via Venmo

- Launch the Venmo app and then navigate to the “Crypto” tab at the end of the menu.

- Choose “Bitcoin (BTC)” from the list of cryptocurrencies. The price of the Bitcoin exchange can be found on the webpage.

- Go to “Buy” at the bottom of the page.

- Enter the amount you wish to purchase in BTC and then tap on the “Review” button. This confirmation step will confirm the details of the purchase like the bank account, the conversion rate, and transaction fee before completing the transaction.

- The application will deliver an overview of the value of Bitcoin to be bought and any costs.

- After you are satisfied with the information After you’re satisfied, press on the “Buy” button to complete the Bitcoin purchase using Venmo.

When you have completed a purchase, the cryptocurrency acquired via Venmo becomes irrevocable. This means that customers have to be able to trade in their digital currency to get back U.S. dollars. It’s important to know that Venmo doesn’t add the user with compensation for any loss caused by price fluctuation.

After having successfully purchased Bitcoin via the Venmo app, users are able to easily monitor the price changes within the app. It also provides historical prices for the cryptocurrency selected as well as transactions that have occurred in the past with the digital asset.

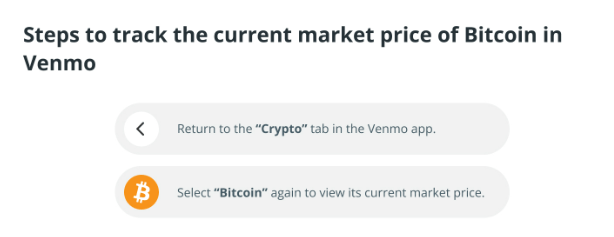

The steps to keep track of the value of Bitcoin in Venmo

In Venmo, the value of Bitcoin can be monitored together with these steps:

The Venmo app can keep track of the prices of cryptocurrency in real-time, and updates are made every couple of seconds. By default, it displays an underlying line graph to display price fluctuations over a 24-hour time period. The time frame used for price fluctuations can be changed to one week, one month, and six months. Then, it can be changed to an entire year or even the duration of the cryptocurrency you choose. The timeline graph gives more specific figures for the period of time.

Venmo charges for buying Bitcoin

The process of purchasing cryptocurrency through Venmo will incur fees dependent on the size of the purchase and the transparency of the fee in transactions. The fees are comprised of the difference between the market rate from Venmo’s trading partner, Paxos, and the currency exchange rate for USD, as well as the transaction fee that comes when purchasing cryptocurrency. Venmo provides both rates in cryptocurrency transactions and has an estimated 0.50 per cent spread, dependent on market conditions.

It’s important to remember that Venmo does not disclose the exact spread of every transaction. Utilizing Venmo’s crypto services, users agree to pay the exchange rate applicable to them, including spreads and the fees that go with it.

Furthermore, in the event that a linked debit or bank account is used as a financing source to purchase digital assets, more costs for banking, like overdraft fees, could be charged. Venmo isn’t responsible for fees imposed by banks. Therefore, it’s crucial to be aware of the fees charged by banks when these sources of funding for crypto transactions are used together.

Who can purchase Bitcoin using Venmo?

To purchase Bitcoin via Venmo, the application has to be opened with a specific user profile must be met.

- Age Requirement: The user must be at the bare minimum age of 18.

- Location Access to Cryptocurrency Services is available to those who reside in the U.S., except for Hawaii.

- Payment methods: A Venmo balance bank account or a debit card are required.

- Unique mobile phone number: Users require a unique U.S. cell phone number that is not connected to any other Venmo account.

Anyone who meets these requirements can open a Venmo account and continue to acquire Bitcoin. To be able to use cryptocurrency transactions through Venmo, the user’s identity has to be verified. This process requires important information like a Social Security number or an individual Taxpayer ID number. Additionally, these services are only available for private Venmo profiles and are not available for charity or business profiles.

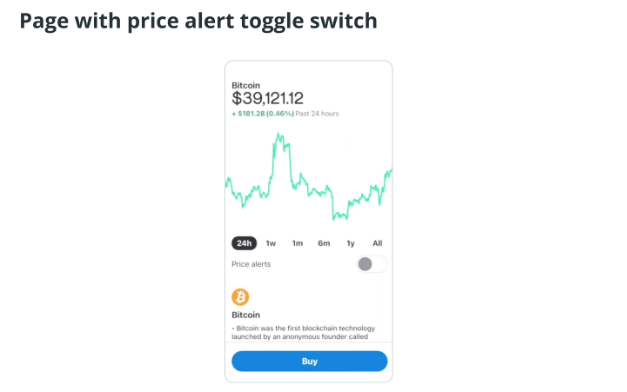

Price Alerts in Venmo

To keep track of Bitcoin market developments and developments, Venmo’s Crypto Price Alerts can assist in observing and reacting to price fluctuations in crypto helping to make timely and well-informed decisions in the current financial environment. When you activate crypto price alerts and push notifications, they will be sent out when the price of the selected cryptocurrency experiences changes in its daily percentage.

It’s important not to rely solely on them for cryptocurrency-related decisions. Price alerts on cryptocurrency can experience interruptions or delays due to market conditions or interruptions to data. Therefore, confirming the accuracy of any information you receive via an alert prior to making any decision is advisable.

To set up Bitcoin price alerts to be set up in Venmo:

- Click on”Crypto. “Crypto” tab.

- Select “Bitcoin.”

- You can activate Price alerts with the Price Alerts toggle.

- Once the program is activated, enter the percentage you want to use for price fluctuations. This percentage is adjustable as required.

- If verification of identity through Venmo is completed and the account is set up to allow cryptocurrency transactions, it will be possible to sign up to price alerts when you purchase Bitcoin.

Securing and protection measures are in Venmo.

Venmo utilizes data encryption to protect its users from fraudulent transactions and warrants the security of information stored on secured servers. Venmo’s mobile payment service lets users sign out of their Venmo accounts from stolen or lost phones and set up individual identification numbers (PINs) to be used in mobile apps and also enable 2-factor security (2FA).

In spite of Venmo’s security procedures, Users should be aware of the potential dangers, such as fraud and scams from cybercriminals. While the root of these issues may not be directly related to the application that makes payments, the consequences could directly affect Venmo users. It’s important not to share login credentials and use secure passwords. Make accounts private, and only transact with trustworthy businesses and individuals.

According to research findings, Venmo is openly revealing all peer-to-peer transactions on its website by default, except for the amount of the transaction, which may disclose sensitive information about users in certain situations. As of 2018, Venmo signed an arrangement with the Federal Trade Commission to address several security and privacy issues that relate to this, among other things, resulting in corresponding changes to the settings. However, Venmo remained under scrutiny for the possibility of exposing users to privacy issues.

There are disadvantages to purchasing Bitcoin via Venmo

Purchasing Bitcoin via Venmo comes with a few disadvantages to be aware of. First the Venmo’s Purchase Protection doesn’t cover transactions in cryptocurrency, making the buyer vulnerable to loss resulting from the fluctuation in price of cryptocurrency. Even though unauthorized activities are covered, Bitcoin transactions on Venmo are not reversible, highlighting the importance of meticulous research and careful making of decisions.

Contrary to traditional banks, Venmo’s bitcoin and investment balances are not protected by the Securities Investor Protection Corporation (SIPC) and the Federal Deposit Insurance Corporation (FDIC) Securities Investor Protection Corporation

(SIPC) and any type of private or public insurance. Thus, the funds that are stored in the app aren’t protected just like those in an account at a bank, making Venmo unsecure for the storage of huge cryptocurrency holdings.

Furthermore any asset or currency that is purchased through Venmo is restricted by the Venmo platform which makes it impossible to transfer cryptocurrency into other accounts or platforms. This can be problematic on those that prefer to store their money in digital wallets, or look into different trading options.