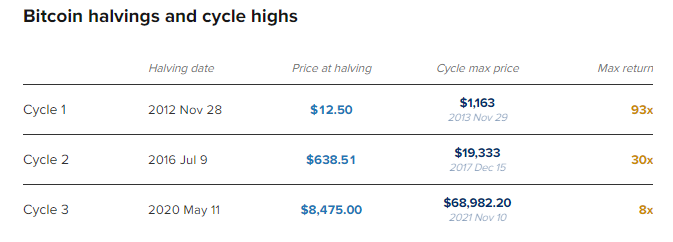

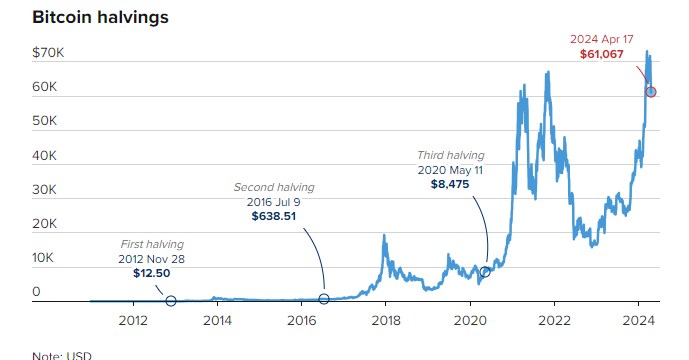

Bitcoin has completed its fourth halving. This momentous event that occurred in April 19 2024 was the day that the block rewards for Bitcoin miners cut in 50, from 6.25 BTC to 3.125 BTC.

This is an adjustment programmed every four years in order to manage the supply of Bitcoin. The halving event decreases the mining rewards by half, directly impacting Bitcoin mining’s profitability. Historically, halving events been followed by significant increase in the value of Bitcoin since the lower supply causes a greater demand for bitcoins.

The Bitcoin halving feature is a recurring adjustment to the amount of reward miners earn to verify transactions and add these to the Blockchain. The initial plan was to distribute 50 bitcoins per block the reward reduces after every two million blocks. The most recent halving cut the amount of reward from 6.25 up to 3.125 Bitcoins for each block. This means that the supply of Bitcoin is limited to 21 million. In April 20, 2024, there was 19.69 million bitcoins available but only 1.31 million remaining to be released as mining rewards.

This Bitcoin block of 840,000 which was the fourth Bitcoin halves, experienced an rise in fees to network due to the fact that many users competed for the limited space. In the end, Bitcoin users collectively spent 37.7 BTC in fees, equivalent to more than $2.4 million at the current price in order to protect transactions within the block.

With the halving event in mind, a variety of Bitcoin mining companies that are that are listed on the Nasdaq stock exchange ended the week trading with a notable 24 hour rise in shares prices as they prepared for the Bitcoin halves event. In addition, Riot Platforms (RIOT) had the highest rise among the publicly traded Bitcoin mining companies on April 19’s trading day, as its share price rising in 10.13 percentage points to $9.13.

The Bitcoin halves excitement has resulted in an end to the weeklong ETFs outflow record, with an inflow of net positive within the United States exchange-traded funds (ETFs) market prior to Bitcoin day of the halving. This was due to the anticipation for an improve in value of the market post-halving and led to strategies for investing across the world recommending adding Bitcoin to portfolios that already have.