- El Salvador’s strongman intensified his push for BTC despite the fact that it has a low rate of adoption

- Bukele remains optimistic about Bitcoin’s future

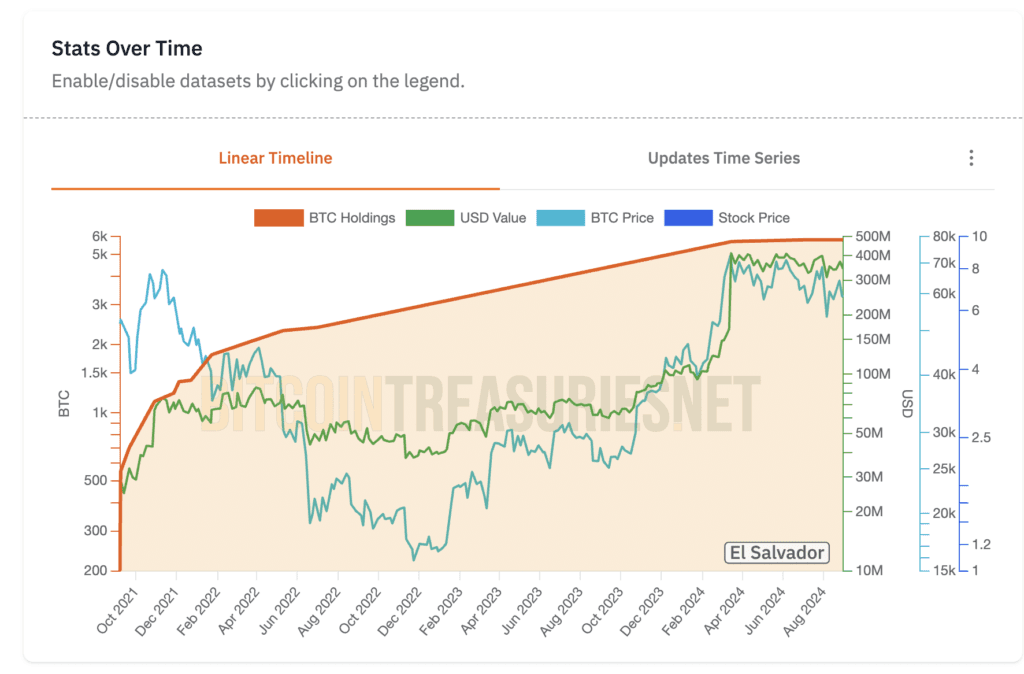

Nayib Bukele, the president of El Salvador, was the subject of much criticism when he acknowledged Bitcoin as a legal tender throughout the country, particularly from the International Monetary Fund and the World Bank. In the three years since then, however, the country has now $400 million in BTC reserves. This is because the decision to use BTC as a reserve asset appears to be a great idea.

This is the main Bukele’s recent interview with TIME. According to the President of El Salvador, although the experiment hasn’t been a perfect success, “the positives have so far outweighed the negatives.”

Adoption is low, but it’s still a “net positive.”

Why is the statesman thinking that way? It’s because adoption hasn’t always been as rapid as Bukele insisting on this during the same interview. But he is convinced it is true that Bitcoin is a cryptocurrency with an upcoming future, even though it’s not considered the “currency of the future.

In reality, El Salvador’s President believes that the greatest benefit of El Salvador’s decision to adopt BTC is that it was entirely voluntary. He stated,

“The positive aspect is that it is voluntary; we have never forced anyone to adopt it. We offered it as an option, and those who chose to use it have benefited from the rise in Bitcoin.”

Despite the lower-than-expected adoption rates, Bukele believes there is “still time to make some improvements.” In actuality, the nation’s entry into Bitcoin has been considered a “net positive,” which is confirmed by the fact that the Bitcoin Treasury holdings amount to around $400 million at present.

Other benefits as well.

Apart from the financial advantages, El Salvador has also been receiving enough branding, tourism, investments, and even interest. The anticipated opening of the “Bitcoin City” is an example of many organizations owned by state and private entities following the example of the country entering this particular asset class. In a lot of ways, El Salvador had the “First Mover” advantage over other countries that are also doing the same thing with Bitcoin.

He continued,

“The fact that major Wall Street companies are now engaging in it—something that seemed unthinkable three years ago when we did it—shows its impact. Some countries already hold reserves in Bitcoin or are investing in Bitcoin and Bitcoin mining.”

This is where the importance of what he’s saying is important to emphasize, especially because cryptocurrencies are an alternative to traditional assets and will be an issue that will be discussed in the coming U.S. elections. Former President Trump is an example. He has already made a shift toward cryptos and even accepted cryptocurrency in the form of donations. Contrarily, Vice President Harris has been more cautious, and this could be working against her during November.

This could be the reason that El Salvador’s president continues to stoke the fire on Bitcoin, as the country is scheduled to purchase more BTC to fund its treasury in the near future. Indeed, it has had such an impact that, despite initial doubts, the IMF released the following report in the year 2000: “the risks of Bitcoin in El Salvador have not materialized.