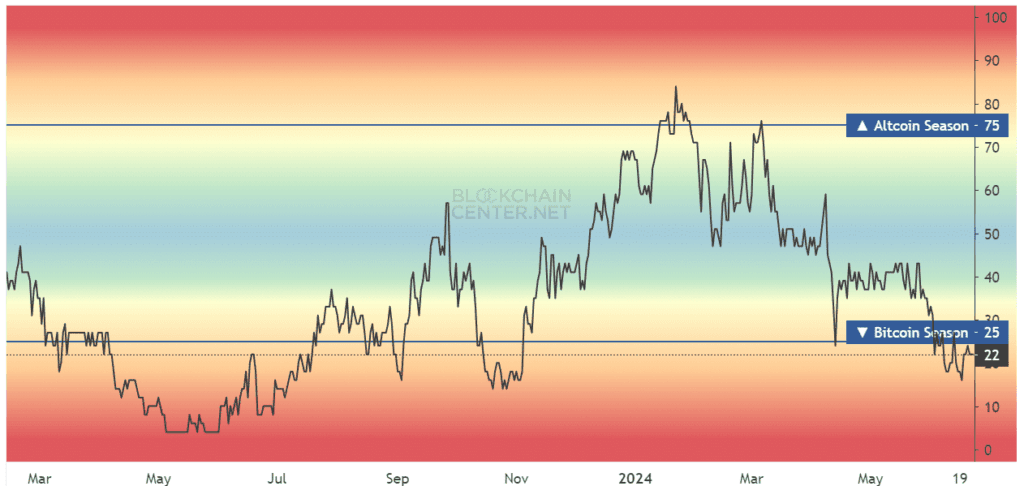

The 2021 altcoin season officially ran from March to June, while 2024 has yet to start up properly.

The Altcoin Season Index showed investors should take their time. Due to an abundance of new tokens being issued this cycle, participants will need to be more selective with their altcoin bets this time around.

At press time, Bitcoin [BTC] was trading at $61.5k – only 3% above its range low of $59.7k which had been successfully defended in early May before bulls attempted a rally to $72k but eventually gave up.

Returning to this key support indicated that BTC had not left its consolidation phase yet and wasn’t ready for an upward trending pattern. Liquidity clusters below $60k could entice prices there and lead to deeper correction than expected by most market participants.

As Bitcoin struggles to find an upward trajectory following its halving, it is not surprising that most altcoins also experience bearish pressure; investors do not yet possess enough capital to sustain rally attempts of altcoins.

Investigating the Altcoin Season Index- The readings are dismal

The Altcoin Season Index attempts to measure market sentiment and performance; whether Bitcoin or altcoin sector is performing better over a 90-day window, according to this index. If 75% of top 50 altcoins outshone BTC during that timeframe it is referred to as Altcoin Season.

As things currently stand, however, such an event seems far away due to a lack of capital inflows and speculation resulting from lack of investor interest in altcoins.

Once Bitcoin makes a strong upward move, its price often stabilizes and BTC holders choose to invest some of their wealth into altcoins based on fundamental analysis, tokenomics and market sentiment for an outsized return.

Before an altseason can take place, Bitcoin must experience dramatic gains like it did from October 2023 to January 2024.

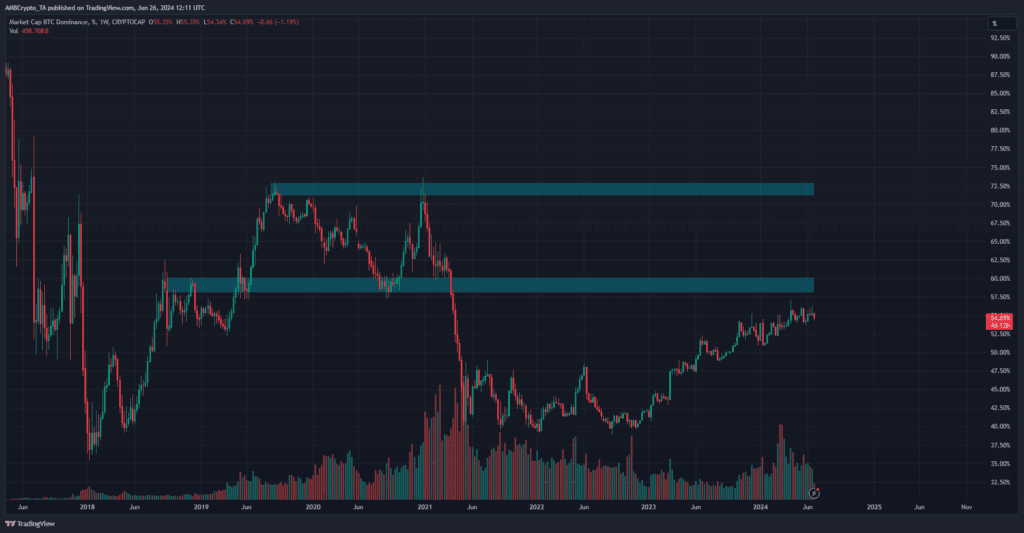

Long-Term Implications from the Dominance Chart

The 2021 altcoin season officially ran from March to June according to the altcoin season index; however, when looking at the BTC.D chart above we can observe that Bitcoin dominance began its downward trajectory in early 2021 before initiating its recovery during the second half of that same year.

An increase in BTC.D can serve as an indicator for altcoin season, signifying its increased usage relative to Bitcoin.

Since March, altcoin markets have experienced a relentless downward spiral. While longer term trends remain positive, recent pullbacks have been especially brutal.

As altcoin pools diluted and more tokens from existing projects were unlocked, demand had to skyrocket in order to stay ahead of this expanding altcoin market.

As such, this cycle could result in incredible gains being concentrated among fewer alts than in 2021 or 2017; and returns might also be more muted since participants no longer make early moves.