BlackRock’s IBIT bitcoin ETF on Nasdaq inflow streak ended on April 24 after IBIT registered no inflows for that day, according to data provided by Farside.

In Brief :

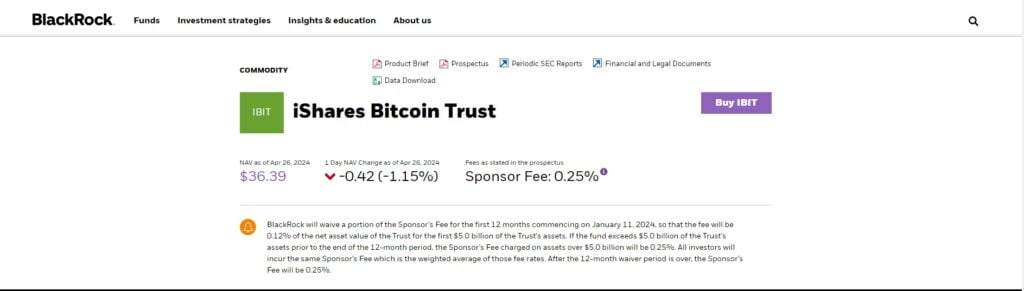

- BlackRock’s iShares Bitcoin Trust (IBIT) has experienced no new investments.

- This absence of flow does not necessarily indicate diminishing investor interest.

- The lack of inflows into BlackRock’s IBIT occurs while Bitcoin consolidates.

Since IBIT went live on January 11, its fund has not received any investor investment for 71 consecutive days; seven out of the other ten funds followed its example and did not withdraw.

Fidelity’s FBTC and the ARK 21Shares Bitcoin ETF (ARKB) both saw inflows of $5.6 million and $4.2 million, respectively; Grayscale’s GBTC experienced outflows totaling $120.6 million — its highest cumulative outflow since April 17.

On January 11, Spot ETFs made their US debut amid great fanfare, promising to attract billions in institutional capital. Since their introduction, BlackRock’s IBIT fund alone has amassed more than $15 billion, while overall, 11 funds combined have experienced net inflows of $12 billion or more.

However, most inflows occurred in the first quarter, and the uptake dropped substantially this month, dampening Bitcoin’s bull run momentum.

Bitcoin (BTC), the leading cryptocurrency by market capitalization, has mostly traded between $60,000 and $70,000 this month – marking a weak follow-through after its near 70% surge to record highs above $73,500 during Q1.

Explaining BlackRock’s Zero Inflows

Some community members have taken the current zero flow trend as an indication of diminishing investor enthusiasm for Bitcoin; however, Bloomberg ETF analyst James Seyffart explained that such patterns were typical across all ETF markets.

Zero flows occur when there is no discernible difference in supply and demand for an ETF, according to Seyffart. He suggests that for this process to happen, it must be substantial enough for new ETF shares to be created or redeemed through units created or redistributed as units are purchased or returned by unit holders.

Market makers only intervene when a discrepancy exceeds a predefined threshold.

Minor mismatches will allow market makers to trade shares like stocks. However, more than one creation unit needs to occur either way for market makers to access APs/underlying markets, according to Seyffart, successfully.

BlackRock IBIT’s ETF does not experience inflows due to a lack of trading activity; its net flow is insignificant enough that units were neither created nor redeemed during that period.