An exchange company, Cboe Global Markets (CBOE.Z), has opened a new tab and submitted a request to the U.S. Securities and Exchange Commission on Monday, seeking to include exchange-traded funds (ETFs) linked to the cryptocurrency Solana, which requires the agency to take a decision within March.

According to SEC regulations, the agency has 24 hours to decide whether or not to accept Cboe’s “19b-4” application to list VanEck’s products and the digital asset management company 21Shares. These are the first ETF products that are tied in relation to price Solana, which is the fifth-largest currency, adequate to CoinGecko.

VanEck and 21Shares submitted applications to the SEC in June to introduce the new products. In June, the SEC must also approve the “S-1” filings before the products are able to begin trading; however, the rules of the agency provide a timeframe for the filings of disclosures by investors.

If they are approved, the products could be a part of a third wave of ETFs that track cryptocurrency prices. After that, the SEC approved ETFs linked to bitcoin’s price in January, which marked a turning point for the sector. The products are subject to a two-step approval procedure.

We are now addressing the increasing investor interest in Solana – one of the most actively traded cryptocurrency after Bitcoin and Ether,” said Rob Marrocco, global head of ETP Listings at Cboe.

VanEck, 21Shares and a few other issuers are waiting for the final approval of the SEC to begin launching ETFs linked to spot prices of the second-largest cryptocurrency, Ethereum.

The approval is expected to be given in the next week, according to two people who are who have been involved in the procedure. Authorities have already granted approval for the exchange’s application to trade and list these new products.

The cost of Solana is in the vicinity of $137.83. This is a decrease from the previous month’s high of almost $150 at the time when the two ETF filings were submitted for the first time, CoinGecko data showed.

Solana ETF outcome hangs on Trump against Biden

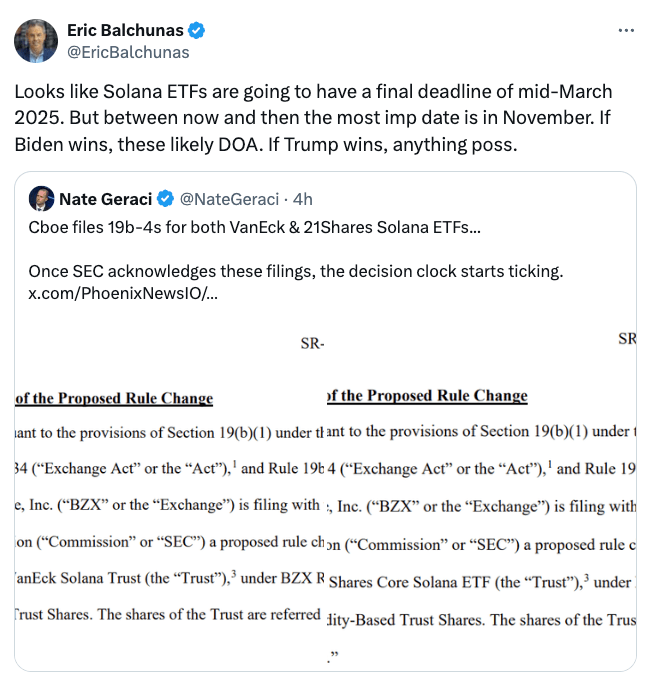

The senior Bloomberg ETF analyst Eric Balchunas warns that the probability of the Solana ETF approval by the SEC is heavily dependent on whether or not Donald Trump is elected as US president in November.

“Looks as if Solana ETFs will be able to close at mid-March 2025. Between now and then, the most crucial date is in November.” Balchunas wrote in a July 9 blog post on the website X.

Balchunas claimed that should president Joe Biden win the election, Solana ETFs would most likely become “dead on arrival,” however, should Trump win anyway, anything could happen.

In a research report, cryptocurrency market maker GSR Markets predicted the approval and subsequent launch of the spot Solana ETFs within the United States could potentially raise the price of SOL by nine times the amount.