Since 2021, a number of companies have discovered a new method to attract talent from around the world, notably millennials and Generation Z. The newfound attraction of cryptocurrency payments and bitcoins is the result.

A Nasdaq Press Release mentions that, according to a global survey, more than one-third of millennials, and over half of Gen Z, would be happy if they received 50% of their salaries in Bitcoin or cryptocurrency.

Many global companies are already on board. The list of companies that pay their employees in cryptocurrency is long.

- GMO Group in Japan has announced recently that employees will be paid in Bitcoin. The company is focused on Internet infrastructure, online advertising and finance.

- Since 2013, SC5, a Finnish Internet technology company, pays its employees using Bitcoins.

- Purse.io is a San Francisco-based company that pays its employees using Bitcoins.

Many Indian freelancers, IT professionals and other IT-related workers are paid in cryptocurrency because it is faster and cheaper than the traditional methods of international bank transfers.

What is Crypto Payroll?

Crypto payroll refers to a system whereby companies pay employees using cryptocurrency instead of traditional money.

Instead of receiving traditional currencies such as dollars or euros on their bank account, employees receive digital currencies like Bitcoin and Ethereum in their digital wallets. It can speed up and even reduce the cost of transactions by eliminating the need for financial intermediaries like banks.

What are the benefits of Crypto Payroll?

1. Flexible and customizable

While Bitcoin is just one option, there are a href=”https://www.cnbc.com/2022/06/03/crypto-firms-say-thousands of digital currencies will collapse.html#::text=the%20coming%20years. While Bitcoin is just an option, there are countries, such as Germany, Singapore Hong Kong, Switzerland Thailand, Puerto Rico, Malta and Seychelles. Some countries offer significantly lower taxes for employees who are paid in crypto. Crypto pay allows employers to reduce costs by reducing their tax burden.

4. Savings in time and money

Opening a crypto wallet is much easier than opening bank accounts in the respective jurisdictions. Employers can save money by using this method. The traditional banking network, such as SWIFT, is slow and charges high fees for transactions that cross borders. Both the employer and employee benefit from crypto payment.

5. Hedging against FX fluctuations

Currency rate fluctuations are risky when global teams include members from around the world. Crypto payroll makes sure that employees are paid fairly, regardless of currency fluctuations.

6. Currency conversion is not necessary

Cryptos are the same in all countries, unlike traditional currencies. A crypto salary has the same value whether it is in India, France or Colombia.

What are the challenges of Crypto Payroll?

1. Fraud risk

As cryptocurrency has not been integrated into the banking system yet, you will need to invest in a cryptobrokerage firm separately for your crypto transactions. Crypto transactions are pseudonymous, and financial institutions do not verify the identity of the recipient. Fraud risks are therefore associated.

2. Crypto payments that are irreversible

Cryptocurrency is decentralized and no financial institution or bank has control over it. You must contact the account holder directly if you want to ask for a refund.

3. Value functional risk

Cryptocurrency is similar to stocks in that its value can fluctuate at any time. If the crypto value is higher than a certain threshold, you may be subject to tax litigations or non-compliance.

4. Tedious process

It can be a tedious process to do a crypto-payroll for the first few times, as each crypto-payroll requires multiple approvals. There are also the chances of human error, such as paying into the wrong wallet or paying twice. It’s also easy to lose track when it comes to crypto payments.

Tracking the accounts that are paid and those that are pending, for example. The finance team finds it difficult to manually verify if each account has received the crypto salary before they confirm their beneficiaries.

5. Financial reporting

Crypto payroll is difficult to report on because it’s impossible to link them to the company’s account. It also complicates the calculation of employee and employer taxes because it depends on where the employee is located.

Tax implications of crypto

Different countries have different tax implications for crypto. In 2014, for example, IRS issued a notice that stated all virtual currencies including cryptocurrency are treated as assets under Federal Income Tax. The IRS notice gave examples of how long-established tax rules that apply to property transactions are also applicable to virtual currency transactions.

Here are some examples of the tax implications for crypto in various countries.

1. India

After the 2022 budget, India’s cryptocurrency tax implications changed. The Central Board of Direct Taxes imposed a 30 percent tax as well as a surcharge and 4% cesses on profits from crypto transactions. In addition, a 1% Tax is Deducted At Source (as per section 194S Income Tax Act), if the transaction exceeds INR 50.000 or INR 10,000 (in some cases). Indian exchanges automatically deduct TDS.

2. UK

The UK does not have any cryptocurrency-specific law. The UK considers cryptocurrency as a form of property. It requires crypto exchanges in the UK to register with Financial Conduct Authority. For crypto payments or transactions, one must fill out cryptocurrency-specific reporting documents, anti-money laundering, and combating the financing of terrorism (CFT).

The UK cryptocurrency tax is based on the type of transaction. In 2023, PS12 570 is exempt from tax. Above this amount, a tax of 20-40% will be applied.

3. United States

The US government does not consider crypto currency, but rather as a form of property or investment. The amount of tax you pay on crypto assets in the US depends on your earnings, the transaction and the length you’ve owned the asset.

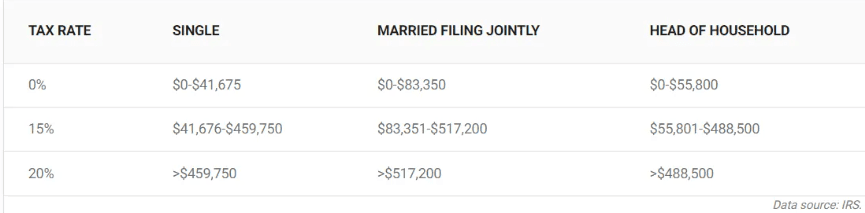

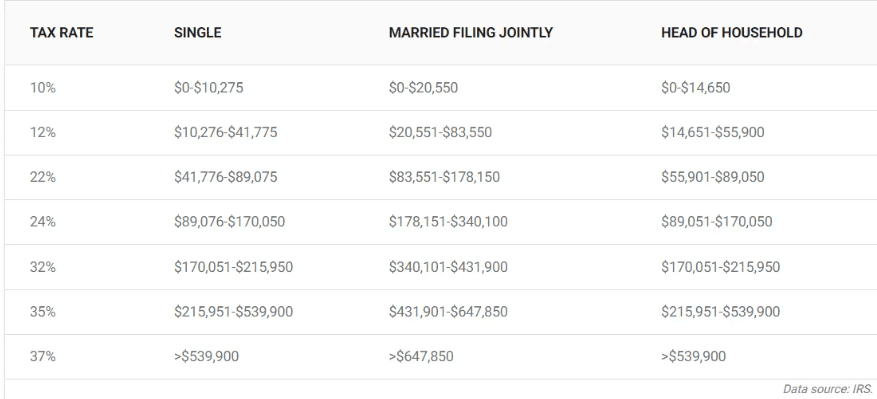

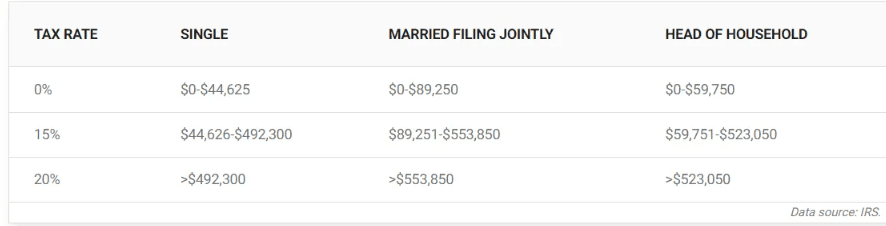

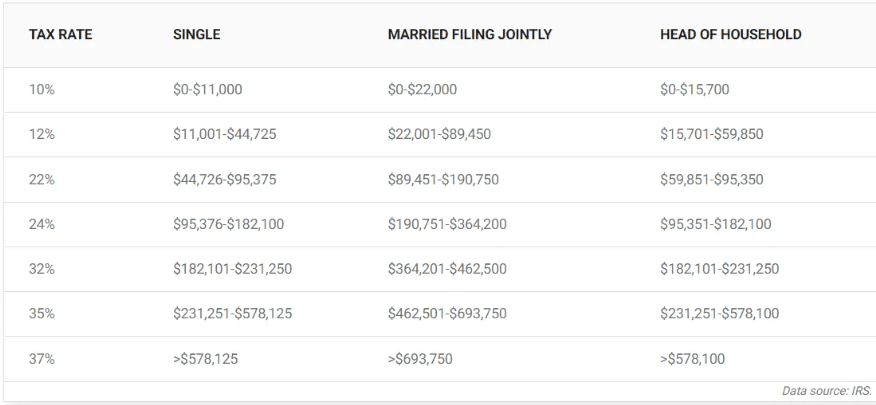

The following crypto tax rates apply in 2022 and 2023 if the asset is held for less than 365 days.

4. Singapore

Singapore classifies cryptocurrency as property. The Monetary Authority of Singapore issues licenses and regulates cryptocurrency transactions in the country. Singapore is a safe haven for crypto transactions because it does not tax long-term gains. Taxes are levied against companies that conduct crypto transactions regularly, as it is a form of capital gain.

Eight Best Practices for CryptoPayroll

1. Get employee authorization

It’s good to get written permission from your employees if they wish to receive a portion of their salary as crypto. You will then have a written document to refer to in the event of a dispute. Draft the declaration document with your HR and legal team.

2. Partner with a crypto-agency

Consider partnering up with a third party agency rather than buying cryptos and holding on to them until payroll is generated.

3. Minimum wage in local currency

Some countries have crypto regulations that are very strict. The US labor law, for example, requires employers to pay wages and overtime in US dollars. Bonuses can be paid out in Crypto.

4. Taxes are not forgotten

Don’t forget about taxes when you pay your employees with crypto. Employees must pay capital gains tax on any increase in the value of their crypto salary.

5. Check local tax implications in the country

Be sure that the country where the employee lives has legalized crypto-payroll before making any crypto payments. If yes, you should also consider the tax implications.

Here are some of the local tax implications for crypto in a few different countries:

| Country | Legal Stance | Tax Implications |

|---|---|---|

| USA | Legal regulations vary from state to state. | Capital gains and taxable income for crypto salary. |

| UK | Accepted | Treated as capital gain for investors and ordinary income for traders. |

| India | Accepted | 1% TDS at source. |

| Malaysia | Accepted | Treated as income generated through conventional business. |

| South Africa | Accepted | Treated as taxable income or capital gains. |

| Australia | Accepted | Treated as capital gains for investors and ordinary income for traders. |

6. Select a stablecoin

Stablecoins will streamline your accounting and admin process, as paying each employee their preferred cryptocurrency is difficult.

7. Divide the payment

Consider splitting up the payment instead of paying in full. Paying the bonus or pension scheme contributions in crypto, for example.

The splitting of cryptopay has a number of advantages. The employee feels safe, while the employer is able to comply with minimum wage laws. The employee will not suffer if the value of the crypto currency falls, while the employer can still comply with local laws.

8. Payroll software that is crypto-friendly

You are already familiar with the benefits of payroll software. It streamlines your entire payroll process. If you are planning to implement crypto payroll, make sure your payroll software is compatible with crypto transactions. Crypto-Friendly Payroll Software ensures that the payroll processing will be taken care of from end to end, as well as ensuring compliance with laws and tax reductions.

What is the Best Crypto Payroll software?

1. Compliance and Security

Choose crypto payroll software which is secure and tax-compliant. Protecting sensitive employee data is essential, as well as understanding the tax implications for crypto transactions.

2. Support for Cryptocurrency and integration capabilities

Choose software that integrates seamlessly with your existing business systems and supports major cryptocurrencies, such as Bitcoin, Ethereum or USDC.

3. Cost-effectiveness, Efficiency and Effectiveness

Look for affordable crypto payroll software without compromising on efficiency. Consider features such as automated payroll processing, no hidden fees, and tax calculation.

4. Customer Support and Software Reliability

Verify that the software provider has a reputation for providing excellent customer service. Check out customer reviews and get feedback from peers in the industry.

5. Easy of use and Scalability

Software that is easy to use and can grow along with your business will help you adopt it quickly and reduce the need for lengthy training.

FAQs

What is the regulatory framework for crypto?

The crypto regulation differs from one country to another. This includes their financial status (i.e. as a currency or security), legality as a means of exchange and the requirements for fraud and laundering checks on payers and recipients. Taxation is an important regulation in the context of payroll and particularly for employees. Some countries treat crypto as property while others tax it as currency.

Is it safe to pay in crypto?

Although cryptocurrencies don’t offer the same protections to consumers as fiat money, they are a secure way to pay. It is important that employees have a good understanding of the blockchain and cryptocurrency work. This includes wallets and private/public keys and how to protect against theft, scams and accidental losses.

Why would employees prefer to receive crypto payments?

There are many reasons why employees want to be paid in cryptocurrency. There are many reasons why employees want to receive their payments in cryptocurrencies.

Are employees taxed on crypto payments?

Employees are taxed when paid in cryptocurrency. Tax treatment for cryptocurrency payments can vary from one country to another and depends on various factors. Some jurisdictions, for example, treat cryptocurrency payments as taxable income. However, it may also be subject to capital gains tax if sold. Employers might also be required to report, for example by providing tax documents detailing cryptocurrency earnings.

an I pay my staff in crypto and fiat currency?

Employees are taxed when paid in cryptocurrency. Tax treatment for cryptocurrency payments can vary from one country to another and depends on various factors. Some jurisdictions, for example, treat cryptocurrency payments as taxable income. However, it may also be subject to capital gains tax if sold. Employers might also be required to report, for example by providing tax documents detailing cryptocurrency earnings.

Can I pay my staff in crypto and fiat currency?

It is possible to pay employees both in cryptocurrency and fiat money. This is often called a hybrid payroll system, and it provides flexibility to both employers and their employees. This approach comes with added complexity in managing multiple payroll systems and payment channels, as well as tax implications.