GameStop stocks GME Crypto set off a circuit breaker today after experiencing a 54% jump, according to multiple reports. This spike could be related to RoaringKitty returning on X this Monday after nearly three years away.

KEY POINTS:

- “Roaring Kitty,” who led the GameStop mania of 2021, posted online for the first time in nearly three years.

- Monday was marked by multiple trading halts due to extreme volatility at GameStop.

- Roaring Kitty (aka Keith Gill) was once employed by Massachusetts Mutual Life Insurance to market its policies.

Keith Gill, commonly referred to by his handle RoaringKitty online and in person as RoaringKitty, can be largely credited with sparking GameStop stock’s surge in late 2020. Working as a financial analyst and having come to believe GameStop stock was undervalued, he began sharing this belief on X and YouTube platforms using RoaringKitty as his handle.

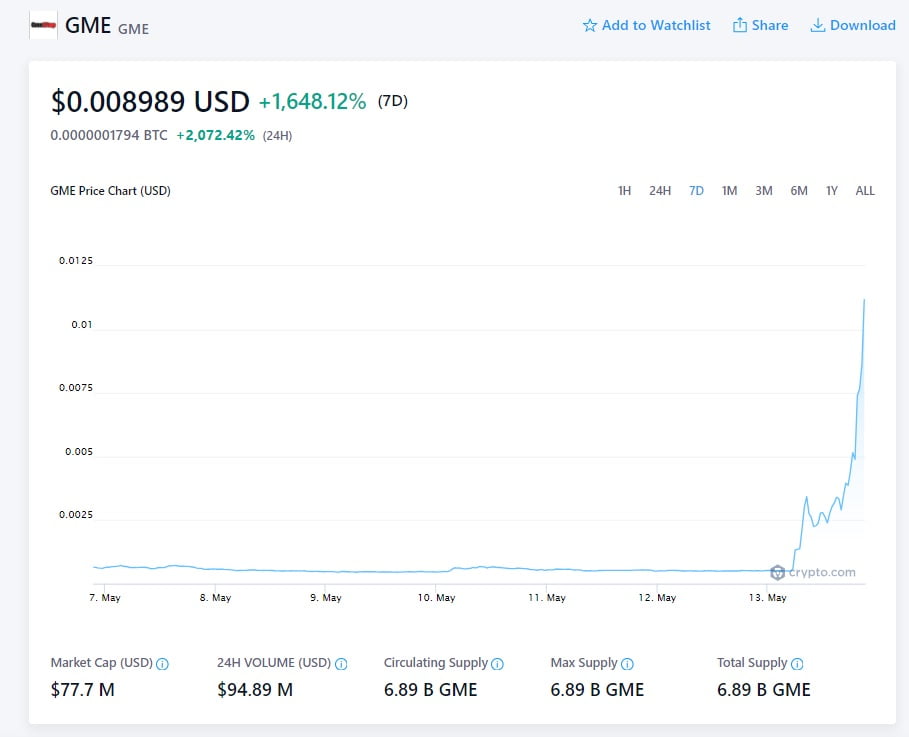

Meanwhile, meme coins tied to GameStop and RoaringKitty on Solana have experienced dramatic price surges over the past six hours. GameStop (GME), an obscure coin designed to take advantage of misspelled names, rose by an incredible 1,957%, and Kith Gil (GIL), which refers to RoaringKitty’s real name, saw its price increase by 1,960% during that same timeframe.

DeepF*ckingValue (ROAR), one of Gill’s pseudonyms, saw its value increase by 1,264% within six hours – becoming one of several Solana meme coins to demonstrate stellar rises over this period. RoaringKitty (KITTY) experienced the largest leap with an 11,045% increase.

Keith Gill, commonly known online as Roaring Kitty or DeepF*ckingValue, has released a cryptic meme on X.com.

Gill made an important post regarding GameStop case events and the subsequent shutdown of the WallStreetBets subreddit in roughly three years during the time elapsed since these incidents took place.

The meme shows a man leaning forward from a sitting position while holding what appears to be a smartphone while sitting on what looks like a red chair with the red arrow pointing right, indicating some kind of movement or change in direction.

Gill can be widely credited with initiating GameStop’s stock surge in late 2020. She worked as a financial analyst, was convinced that GameStop stock was undervalued, and expressed this conviction online via Twitter (now X) and YouTube channels under her handle RoaringKitty.

Gill first purchased $53,000 worth of GameStop stock in 2019, then started posting about it on social media, leading retail traders to begin buying it, leading to an exponential rise in its stock price; when GameStop reached $483 per share by January 2021, Gill’s investment had grown into an approximate value of nearly $48 Million.

Gill was revealed shortly after GameStop stock began its upward surge by Reuters using public records to identify him. Later that month, he testified before Congress regarding his role in GameStop stock’s rise and believed it to be “dramatically undervalued.”

Netflix and Sony Pictures released two documentaries about Gill’s journey, “Eat the Rich: The GameStop Saga” and “Dumb Money.” Both series focused on Gill’s life as she navigated life after GameStop.

Solana memecoin ($GME), created to commemorate events surrounding the GameStop controversy, experienced a meteoric surge of 510.9% within eight hours since Gill posted his X post.

Who Is Roaring Kitty?

Gill’s analysis of video game retailer GameStop on Reddit during the COVID pandemic created a viral phenomenon at that time, often cited as one of the main drivers behind its short squeeze in January 2021 as several small-time traders banded together and purchased options and leveraged shares from GameStop.

The stock rose quickly from $4 to over $120 within one month – at its height, more than 13,000% higher than its low of 64 cents in April 2020.

Gill’s initial investment of $53,000 quickly ballooned into nearly $50 million during its peak value, becoming an epic tale of one trader making millions from his bedroom by betting against hedge funds such as Melvin Capital – known for betting against meme stocks that fell in value and other such bets that went against it.

Disclaimer: The author does not currently hold any cryptocurrency worth over $100 in value and purchases only crypto for practical and experimentational use – not investment purposes.