These so-called “old hands” have sold their coins this quarter, which has added to market pressures that are bearish.

Key takeaways:

- A wallet that had been inactive for six years shifted 11,000 BTC to Coinbase on Friday morning.

- These so-called “old hands” have sold their coins this quarter, adding market pressures that are bearish.

- It is possible that volatility will rise further on Friday following the Fed’s announcement of the most popular inflation gauge.

In the blink of an eye, an unintentional whale wallet that was idle for six years sprung into life on Friday morning, transferring Bitcoin to Coinbase as the top cryptocurrency diminished the rise to $62,000.

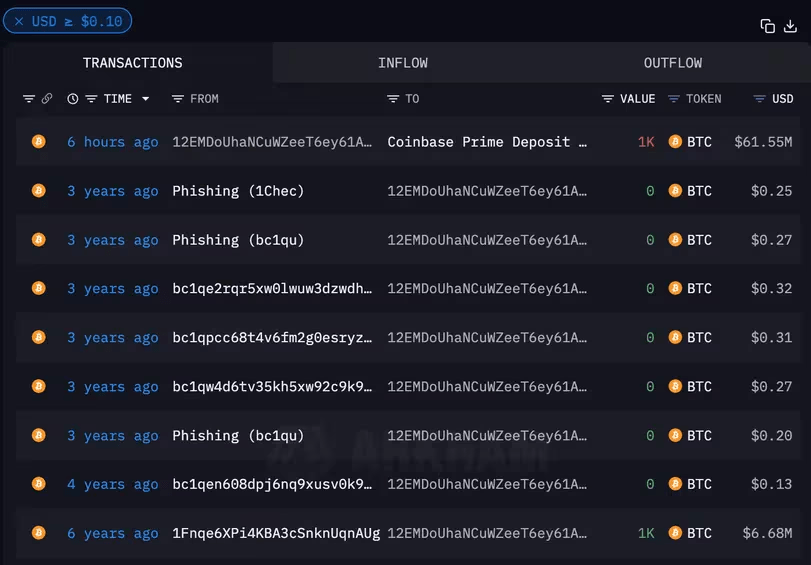

The crypto wallet identified as 12EMDoUhaNCuWZeeT6ey61AkjKyzmjV2m3 deposited a substantial 1,000 BTC, valued at over $61 million, to Coinbase Pro, according to data tracked by Lookonchain and Arkham Intelligence. In addition, the coins were purchased over the course of six years at just $6.68 million. A whale wallet can hold 1000 BTC or more.

In the last quarter, there has been a significant improvement in the number of dormant Bitcoin wallets bursting into action, transferring bitcoins to exchanges. The day before, a Bitcoin wallet linked to the Bitcoin mining company got up after 14 years. It transferred the sum of 50 BTC into Binance.

Analysts believe that these dormant investors could be seeking to cash out when prices are near record highs or participate in speculative activity on the market for derivatives.

The selling by long-term holders, coupled with faster liquidations by miners and the German government’s divestment of coin holdings, has caused prices to fall by almost 9% this month.

At the time of writing, the price of Bitcoin was $61,550. CoinDesk data shows that it has failed to stay above the $62,000 threshold at least four times since Tuesday.

Price volatility is likely to increase in May after the release of the Fed’s most popular inflation gauge, the primary personal consumption expenditures (PCE) cost index. According to Bloomberg forecasts, economists expect that there will be no change to this PCE price index and only a slight 0.1 per cent boost within the main PCE, which will result in 2.6 per cent annual gains in both the headline and core numbers.

A positive inflation reading could make it more likely to consider Fed rate cuts in the coming year, as well as provide a level under BTC that, at present, is on track for a more steep decline towards $50,000, compatible with certain observers.