Recent trends in the United Arab Emirates (UAE) advise that new guidelines ought to correctly ban using cryptocurrencies for payments in the United States of America. This shift has raised issues among criminal experts and industry stakeholders about the destiny of crypto within the UAE.

Key Takeaways:

- New Regulations: On June 5, 2024, the Central Bank of the UAE (CBUAE) authorized new guidelines for charge token services. These regulations require that price tokens need to be backed by means of UAE dirhams and can not be related to other currencies

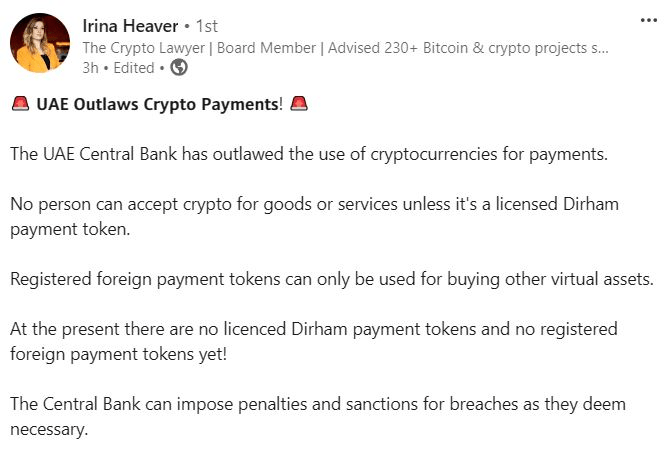

- Legal Interpretation: Irina Heaver, a crypto and blockchain lawyer, interprets these new rules as a de facto ban on crypto payments. She argues that this coverage shift ought to create a much less favourable environment for the crypto industry within the UAE

- Impact on the Crypto Industry: The prohibition of stablecoins like Tether (USDT), which has been a backbone for transactions in the Web3 and crypto space, ought to hinder the arena’s development inside the UAE

- Economic and Regulatory Context: The UAE has been positioning itself as a global hub for crypto and digital belongings, with diverse initiatives and regulatory frameworks aimed at fostering innovation and attracting funding

Crypto and blockchain attorney Irina Heaver believes newly-launched regulations inside the United Arab Emirates (UAE) may additionally prohibit crypto payments within the USA.

On June 5, the board of directors of the Central Bank of the United Arab Emirates (CBUAE) mentioned initiatives under the United States of America’s financial infrastructure (FIT) software, an initiative to boost digital transformation.

In the meeting, the board permitted the issuance of price token offerings regulations to supervise and license stablecoins. The new suggestions suggested that charge tokens in the united states of america need to be backed via UAE dirhams and cannot be linked to different currencies.

UAE attorney believes this is a crypto payments ban

Heaver informed Cointelegraph that the new guidelines forbid crypto bills within the country. Under the rules, the CBUAE is “prohibiting the reputation of cryptocurrencies for items and services until they’re certified dirham price tokens or registered overseas payment tokens, neither of which presently exist.

The blockchain legal professional additionally thinks this new development may contradict the US’s pro-commerce and seasoned funding stance. Heaver said:

Historically, the UAE has thrived on foreign direct investment due to its liberal policies, including the absence of capital controls and the allowance for freedom of contract under the commercial law. This freedom enables the parties to agree on their transaction terms, including payment methods and currencies.”

Heaver additionally highlighted issues about the brand-new development’s alignment with the u. S . A . ‘s financial ideas and impact on foreign funding inflow.

The attorney additionally believes that Tether (USDT) has been the “backbone of transactions” in Web3 and crypto. With the UAE aiming to broaden the arena, Heaver believes that the new guidelines risk its development inside the space with the aid of prohibiting using stablecoins in transactions.

“This policy shift may want to signal a less favorable environment for the crypto enterprise, which is not beneficial for the UAE’s image or its pursuits within the virtual economic system,” Heaver introduced.

The want for stronger industry illustration

Heaver additionally brought up that the UAE lacks enterprise institutions like the Crypto Valley Association in Switzerland. The association lobbied in opposition to unfavourable rules imposed by the Financial Market Supervisory Authority (FINMA) on the subject of staking. Heaver stated:

“The absence of a united voice in the UAE’s Web3 and crypto industry is a significant disadvantage. Existing associations are fragmented and often serve as deal flow and business development platforms rather than advocating for the industry’s interests.”

Heaver introduced that the lack of illustration method that there’s no person who counters regulations that she believes are “now not thoroughly considered” and can be damaging to the boom of Web3 and crypto in the UAE.

The new rules in the UAE ought to lead to a massive shift in the US’s approach to cryptocurrencies, mainly in phrases in their use for payments. While the UAE has been a supportive surroundings for crypto innovation, these adjustments may introduce challenges for the industry, impacting both nearby organizations and overseas investments. The full implications of these policies will rely upon how they’re applied and whether or not any licensed dirham-backed fee tokens are brought in the future.