No bitcoin ETFs at Vanguard? Here’s why. The announcement of ETFs for spot bitcoin has generated media attention and a buzz within the sectors of the market. The reality is that Vanguard has no plans to develop an Vanguard bitcoin ETF, or other related products to crypto. In addition, these items from other issuers won’t be available through the brokerage platform we use.

Vanguard’s Stance on Bitcoin ETFs

Vanguard, which is among the biggest asset managers in the world has taken a strong stand against offering Bitcoin ETFs which sets it apart from the ever-changing cryptocurrency-driven financial market. The company’s position has caused discussion and raised concerns regarding the long-term viability of crypto investment in traditional financial markets.

Vanguard’s Current Position

Vanguard has stated that it doesn’t intend to provide Bitcoin ETFs or other related products to crypto on its platform. . Vanguard’s top executives which includes the CEO who is retiring Tim Buckley and incoming CEO Salim Ramji have always stressed that cryptocurrencies don’t conform to Vanguard’s investment principles .Key reasons behind Vanguard’s decision are:

- Investment Philosophy : Vanguard focuses on asset classes such as bonds, equities and cash, which it sees as the foundation of a balanced, long-term investment portfolio .

- Volatility Concerns The company considers Bitcoin too volatile and therefore not a trustworthy store of value .

- Speculative Nature : Vanguard classifies Bitcoin as an asset that is speculative rather than an investment for the long term appropriate to be used in retirement plans .

- Lack of Intrinsic Value The company believes that the majority of crypto assets do not have intrinsic value in terms of economic value and do not produce cash flow.

Inconsistency with Vanguard’s history

Vanguard’s policy on Bitcoin ETFs is in line with its past strategy for investing in products. Vanguard has a proven history of staying clear of the things it believes are high risk or highly speculative investments. . For example:

- In the 1990s, Vanguard warned investors about its own Growth Index fund during the dot-com bubble. .

- The company previously barred access to leveraged or inverse funds on its platform. .

Market Reaction and Criticism

Vanguard’s decision has been criticized from some crypto enthusiasts. Some customers have threatened take their assets from Vanguard as a response to this policy. . The company is unfazed by the reactions of others as it is confident in its investing philosophy and its long-term perspective .

Potential Future Developments

Although Vanguard’s current position is unambiguous but there are a few elements that could affect Vanguard’s future position:

- Regulatory Changes The introduction of comprehensive regulations in the crypto market could help solve some of Vanguard’s worries regarding investor protection .

- Market Maturation The cryptocurrency market grows and possibly stabilizes, Vanguard might reassess its position .

- Client Demand The continued growth in the market for crypto products could force Vanguard to reconsider its position .

Implications for Investors

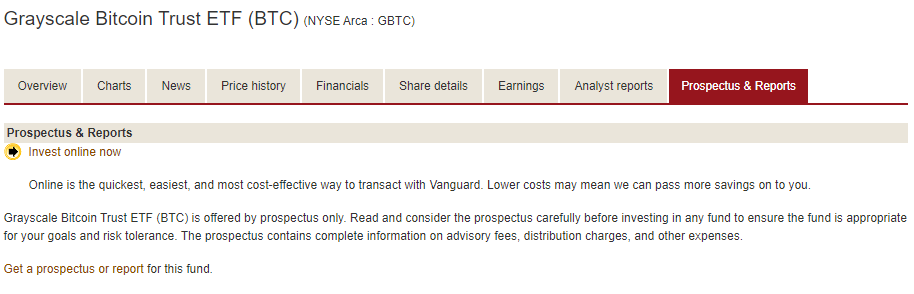

For Vanguard customers who are interested in Bitcoin ETFs The current policy will mean that they’ll have to use different platforms to access these ETFs . Many investors are pleased with Vanguard’s cautious approach and view it as a way of safeguarding long-term investors from the risk of investing in potentially risky assets .

Conclusion

Vanguard’s decision to not offer Bitcoin ETFs shows its investment philosophy that is conservative and its focus on long-term steady growth. This stance is what makes it stand out from other competitors such as BlackRock and Fidelity It also bolsters Vanguard’s image of taking care of the things it believes are best for its perfect interest of their customers. While the cryptocurrency market continues to grow however, it remains to ascertained whether Vanguard will remain in the current position or if it will eventually adjust to changes in market conditions and preferences of investors.