At this stage of technology development, cryptocurrency wallets have transformed financial transactions and processes drastically – thus acting as a disruptive force. Their increasing popularity has caused considerable demand for crypto wallets as secure solutions. Businesses within the Bitcoin sector also see huge benefits from using digital assets to expand their businesses using cryptocurrency wallets as tools.

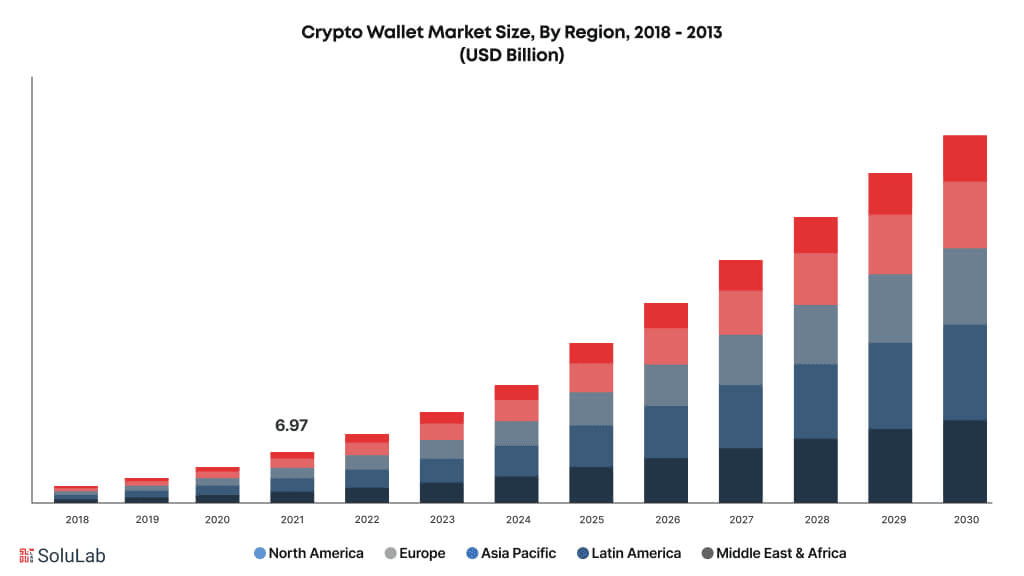

Recently, the global community of cryptocurrency has witnessed rapid development and expansion in terms of cryptocurrency wallet development and growth, leading to an unprecedented demand for secure storage solutions. In this article we’ll be looking at recent trends within cryptocurrencies; specifically their definition and their use – as safe havens that protect users’ private keys for controlling access. Originally the cryptocurrency market size stood at $6.75 billion before reaching $8.42 billion by 2023 with projected annual compounded annual compound growth at 24.8% over this timeframe.

What Are Cryptocurrency Wallets Exactly?

Cryptocurrency wallets are designed to keep your private keys secure so that you can always easily access your funds. They enable you to transmit, acquire and use cryptocurrency such as Bitcoin and Ethereum with the ease and safety required of using Bitcoin and Ethereum wallets – you can transact both cryptocurrencies simultaneously while safeguarding and protecting your private keys at the same time!

Your private keys come with passwords to give you access to cryptocurrency holdings, since cryptocurrencies lack physical tokens like coins, cash and bills for storage purposes. On a larger blockchain it amounts to nothing more than code.

What you will receive with your Bitcoin purchase are two keys – public and private – however if you lose either key, your ability to access cryptocurrency could be at stake and vice versa; ownership of one grant complete privilege over it all; it is therefore vitally important that cryptocurrency wallets keep private keys secure.

How Do Cryptocurrency Wallets Operate?

Cryptocurrency wallets are applications designed for PCs and mobile devices such as tablets or phones that allow access to the blockchain system of cryptocurrency. Cryptocurrencies consist of pieces of data scattered over an unstructured database; wallets collect all these pieces linked to your public address and calculate within their user interface for you.

Coins held by users aren’t physically stored in a crypto wallet; rather, it acts as the key to their money that’s kept safe on open blockchain systems. A user must utilize a private key with unique numbers provided to validate their wallet address before initiating transactions of any type. Depending on which wallet type a person chooses may affect both speed and security considerations – in general crypto wallets provide users with an ability to initiate, sign, and publish transactions to networks; here’s an easy step-by-step breakdown on how crypto wallets operate:

- With the wallet interface, a transaction can be initiated.

- The interface provides you with all of the facts pertaining to any transaction or “intent” of digital offers.

- Click Confirm on the wallet interface page.

- Your private key is used by your wallet to authenticate transactions and is required in order for any successful completion.

- Once a transaction has been signed and sent back into the network, only Internet connectivity makes this possible.

Top Four Types of Cryptocurrency Wallets

The top wallets for cryptocurrency can be divided into two groups, hot wallets which work over the internet, and cold wallets which work offline with physical devices. Here are the types of best cryptocurrency wallets:

Smartphone Wallets

Mobile wallets are an increasingly popular type of hot wallet that allow users to securely send and receive cryptocurrency anywhere with access to a phone number and internet connectivity, smoothly and seamlessly. While mobile wallets do come with benefits such as ease of use and instantaneous transactions, they do come with risks including losing your device due to fraud, malware and hacking attacks.

Web Wallets

Web wallets store your private keys on servers run by third parties such as cryptocurrency exchanges. Web wallets offer the advantage of making funds accessible anywhere with internet connectivity; however, due to third-party involvement they could make your ID and password vulnerable to being stolen by hackers.

Paper Wallets

A paper wallet is an offline solution, where private keys are printed out, written down and kept safe to prevent anyone from hacking into them. In addition, QR codes make accessing them simpler. Despite all their advantages however, paper wallets require additional time and work when managing funds.

Hardware Wallets

Hardware wallets are another popular type of cold wallet, popular among those who prefer more high-tech solutions that provide secure storage for private keys. Known as one of the safest ways to store cryptocurrency, hardware wallets also enable people to sign transactions offline before uploading them directly onto blockchain networks and are accessible from electronics stores.

Non-Custodial Wallet are becoming more prevalent.

Non-custodial wallets offer cryptocurrency pursuits an ideal means of liberating themselves from the control of centralized entities, providing unmatched individual control. Even if one component fails in any entity, such as being vulnerable to single point of failure. Furthermore, money stored within an self-custodial wallet cannot be frozen or taken by a central body.

Any person, anywhere in the world with internet access can quickly set up a wallet without KYC restrictions – thus increasing accessibility and inclusivity and making smooth movement of funds possible. Indirect engagement gives access to decentralized finance ecosystem unlike custodial wallets can.

Impact of Cryptocurrency Wallet Development

As cryptocurrency adoption remains in its early stages, cryptocurrency wallet development services have gained increasing significance over time. More people are investing in cryptocurrencies which in turn increases the demand for cryptocurrency wallets. Here are some major impacts associated with wallet development that might interest you:

- It provides customers with an efficient and safe means to manage their digital portfolio. As cryptocurrency investments increase in popularity, managing investments across various platforms is becoming more challenging for individual investors.

- Cryptocurrency wallets provide superior security compared to traditional banking systems, as their holders are vulnerable to security lapses, fraud, and hacking attacks. Alternatively, cryptocurrency users have complete control of their digital assets as well as multiple-factor authentication for added protection.

- Crypto wallets also present a major impact in their ability to transform the financial sector, offering users access and management of digital assets stored on cryptocurrencies, providing decentralized alternatives for establishing financial institutions and creating growth within crypto wallets themselves. With more companies adopting cryptocurrency-backed wallets comes further innovation within these crypto wallets themselves.

- Finally, business owners, developers and investors can see great opportunity in creating cryptocurrency wallets as they allow them to expand their product offering and penetrate new markets.

Why Does Artificial Intelligence Require for Wallet Development?

Artificial intelligence (AI) has significantly revolutionized Bitcoin wallet development. Users now enjoy more secure transactions, efficient workflow, and personalized experiences thanks to AI solutions that make wallet development possible. Here is an outline of AI roles played during wallet creation:

- Accurate Transaction Monitoring

Crypto wallets with AI capabilities can track payments in real time and provide users with relevant data. By making use of transactional data and analysis of current market trends, these wallets provide tailored recommendations, minimize transaction costs and predict future market movements – giving people the power to wisely choose their cryptocurrencies and maximize returns from them.

- Fraud Detection and Risk Management

AI systems can help cryptocurrency wallet holders effectively manage risks and identify any fraud or threats to protect their investment portfolios. Artificial intelligence has proven adept at analyzing market situations, behavioral trends and historical data for indicators of fraud or potential threats in cryptocurrency wallets. AI also aids users by helping identify vulnerable areas prone to fraudulent activities which protect users from financial loss while helping identify possible weak points for potential fraudulent activity which assists with protecting users against financial loss. For secure transactions AI-powered systems may check counterparties legitimacy and reputation to ensure safe transaction.

- Multi-Factor Verification

Multi-factor verification can be an invaluable asset when applied in certain instances; multi-factor verification systems provide another layer of safeguards against unwanted access while assuring only legitimate users can utilize them to store cryptocurrency holdings. When these extra steps of protection are in place, unwanted access may be reduced significantly and only legitimate accounts can use them to manage cryptocurrency holdings.

- Simplifying User Experience

Facial and voice recognition technology, biometric behavior analysis and natural language processing via artificial intelligence has made the identification process quicker and user-friendly. Biometric identifiers allow users to safely access wallets without needing complex passwords – increasing ease of accessing wallets without the hassle of passwords!

What Factors Affect Cryptocurrency Wallet App Cost?

Development costs associated with blockchain cryptocurrency wallet apps begin at around $15,000. More elaborate wallets could cost as much as $200,000. Cost considerations depend on many variables including:

- Size of App: When designing a cryptocurrency wallet for their business, businesses typically have three choices for wallet sizes to consider. A small wallet usually costs between $15,000-$30,00 as it typically only includes 10-30 experts; mid-scale wallets tend to cost anywhere between $30k-70k since these involve 50+ employees working together; finally large scale wallets run anywhere from 60k-150k since these require 500+ staff working collaboratively together.

- App Type: For any crypto business to thrive, having the appropriate decentralized cryptocurrency wallet is of vital importance. Before beginning construction on its wallet, businesses need to determine which software best suits its business model – these solutions fall into either cryptocurrency-focused solutions such as ICOs, wallets and Dapps; or non-cryptocurrency solutions like logistics and banking services.

- App Complexity: For maximum effectiveness of your blockchain app development solution, make sure it clearly addresses customer problems as well as available solutions and the resources that may be required for implementation. This will assist with finding suitable cryptocurrency wallet development solutions and aid you in selecting suitable wallet development services. These factors all have an effect on its complexity:

- Platform

- Information Technology

- API Integration

- UI/UX Design

- Team Size: When planning the construction of a Bitcoin wallet, one essential aspect is taking into account is team size. More workers may cause the costs to go up; therefore it is advisable to hire internal specialists, independent contractors and use knowledgeable cryptocurrency wallets; your selection will have an effect on its price.

Best Crypto Wallets and Trends of 2024

Cryptocurrency wallets differ from storing cash in a billfold in that they provide a more secure place for cryptocurrency storage. Once selected, the first step should be finding several potential matches based on your individual requirements and desired needs. Here’s a run-down of 2024’s best crypto wallets (hot or cold), to assist in making more informed decisions:

Hot Wallets

- Coinbase Wallet Web3

- MetaMask

- Exodus Wallet

Cold Wallets

- Safe Pal Crypto Wallet

- Ledger Crypto Wallet

- Elliptical Wallet

Major Benefits of Cryptocurrency Wallets

India is trading cryptocurrency regularly, which explains its compound annual growth rate (CAGR) expected from 2024-2032: 54.11%. This growth is not solely driven by growing recognition but also driven by other factors like investment choice, the development of India’s economy and government initiatives as well as an increase in cryptocurrency wallets. Alongside wallet growth and cryptocurrency usage in 2024 there will also be notable trends such as these:

Enhance Security Features

Developers in 2024 are prioritizing advanced safety measures in order to protect users’ digital assets from online attacks, using physical verification processes such as fingerprint and face recognition as well as multi-signature wallet authentication which requires multiple authorizations before transitioning.

Decentralized Payment systems

Decentralization has seen significant gains in 2024, as decentralized wallets become more widespread due to their ability to give users total control of their money and private keys. This trend echoes larger movements towards greater autonomy and transparency within financial operations as well as Decentralized Finance (DeFi).

Development of Mobile Wallets

2024 saw and continues to witness an exponential rise in mobile wallet development due to smartphones’ ever-increasing popularity. Blockchain mobile wallets enable users to conveniently manage digital assets while on-the-go; developers are optimizing them for mobile devices so that they are responsive, lightweight, and rich with features.

Integration of Traditional Systems

Another notable development in 2024 is the combination of conventional financial services with blockchain technology. To facilitate integration, users can link their wallets to credit cards, bank accounts and other services available via traditional financial systems.

Reciprocal Cooperartion

By 2024, cross-chain compatible blockchain wallets had emerged as an innovative advancement of wallets that enable users to store multiple cryptocurrencies from various blockchains within one wallet – providing for increased adoption and use of digital assets while offering seamless transactions across each top blockchain platform.

FAQs

What are Cryptocurrency Wallets?

Digital platforms which provide safe and secure storage, sharing, receiving, and maintenance of digital assets is known as digital wallets – these platforms serve as gateways into the bitcoin ecosystem which enable seamless transactions.

Why Do I Need a Crypto Wallet?

If you want to invest and participate in popular bitcoins and cryptocurrencies, a crypto wallet will allow for safe administration as well as providing an intuitive user-interface that makes assessing digital assets simple and straightforward.

Which is Considered the best wallet for cryptocurrency in India?

A hot wallet, Exodus is being considered the best type of cryptocurrency wallet in India as of recent demand and trends as it provides users with a stacking option which makes it easier to earn a passive income.

If I Want A Secure Wallet Out of All Which One Should I Go For?

At Ledger Live, a cold non-custodial wallet is considered the safest form due to its secure hardware wallet design, offline storage of private keys and regular security audits providing safeguards for digital assets.

Does Cryptocurrency Wallets Only Store Bitcoins?

Yes, cryptocurrency wallets can store multiple cryptocurrencies beyond bitcoin. Some wallets enable users to safely store digital assets like Litecoin, Ethereum and other tokens.