Bitcoin ATMs or BTMs (Bitcoin Teller Machines) have become an increasingly popular means of purchasing or cashing out Bitcoin (BTC). Their increasing use has coincided with an increase in trust for cryptocurrency investments.

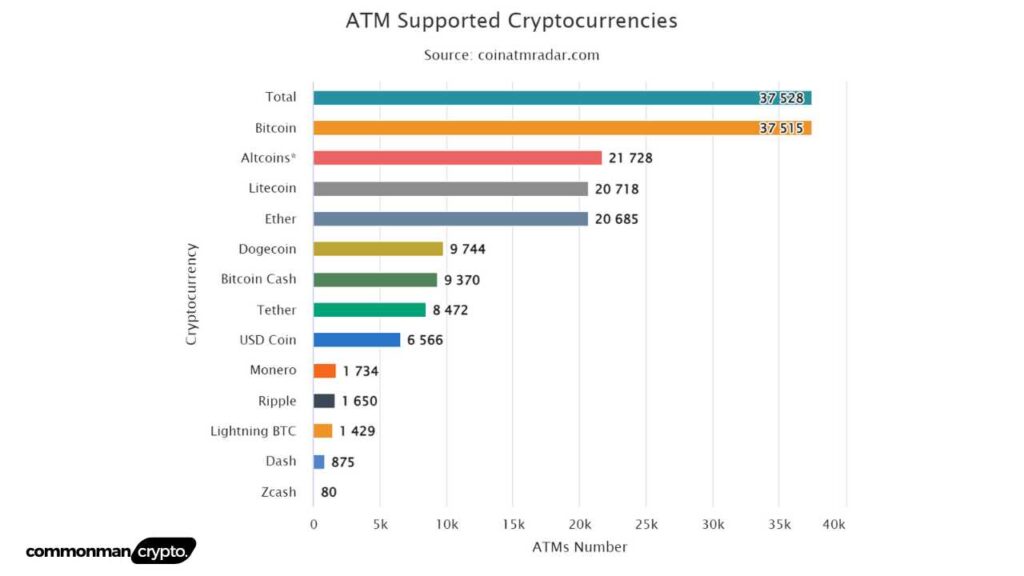

ATMs that provide users with access to additional cryptocurrencies like Ether (ETH), Bitcoin Cash (BCH), Dash (DASH), and Litecoin (LTC), among others, may also be found nearby.

If you haven’t used one before or want more information, continue reading. In this article, we’ll be exploring several key elements of Bitcoin ATMs and providing helpful guidance regarding requirements and steps when buying or selling Bitcoins.

What Is a Crypto ATM?

A cryptocurrency automated teller machine, more commonly called an “ATM,” allows individuals to buy and sell cryptocurrency using cash or debit card. Like traditional bank ATMs, these kiosks and terminals give individuals easy access to digital assets via cryptocurrency transactions.

Crypto ATMs connect users to trusted cryptocurrency exchanges, link their wallets, and facilitate the transfer of funds. While most Crypto ATMs enable users to purchase various cryptocurrencies such as Bitcoin, Ethereum and Litecoin for purchase through ATMs, not all ATMs support selling digital assets like these.

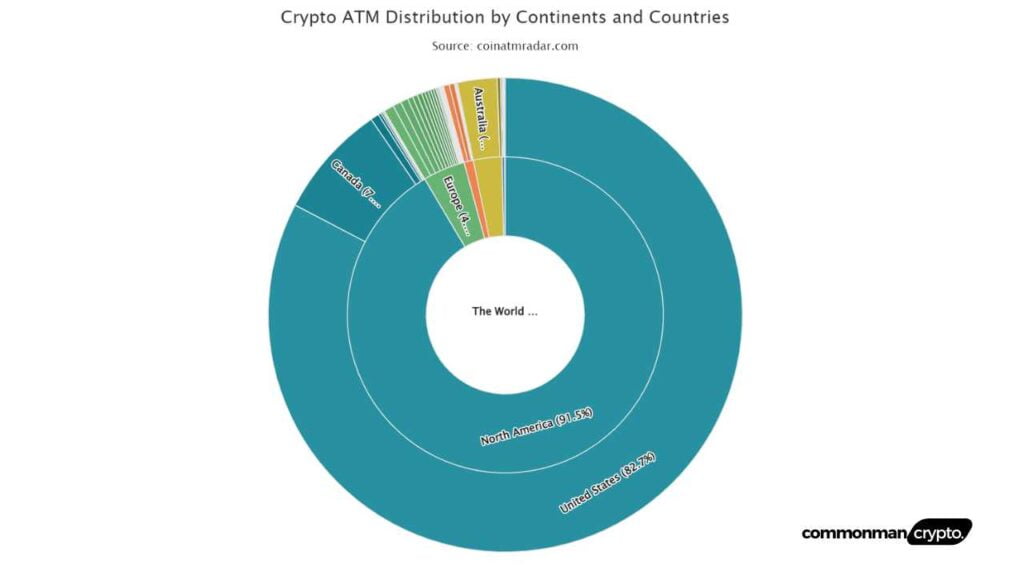

Crypto ATMs have rapidly gained popularity and can now be found worldwide in shopping centres, airports and convenience stores. Their availability may differ depending on a region’s regulatory constraints or market demand; availability may also depend on whether they can accommodate card readers with secure wallets that store cryptocurrency wallets.

What Is a Bitcoin ATM?

A Bitcoin ATM (Automated Teller Machine) does exactly as its name suggests – it accepts BTC and other cryptocurrency tokens instead of fiat currencies like cash. Also referred to as BTMs, buying Bitcoin this way is as effortless as depositing cash onto your bank card via regular ATMs.

Bitcoin ATMs allow users to buy and sell cryptocurrency, but some do not: make sure the ATM you plan on using has the required functionality before choosing one! Crypto ATMs can also send BTC directly to another user’s Bitcoin wallet – simply enter their address in the recipient field.

However, even though ATMs are intended to keep your funds safe from harm, risks can still be involved when using one to sell and buy Bitcoin.

Given the nature of blockchain technology, bitcoin transactions cannot be reversed once submitted – therefore, you must take care when entering all personal details, including your wallet address.

There are various Bitcoin ATM operators, some of whom may be less-than-honorable than others. When choosing an ATM operator from which you have no prior experience, take extra caution by looking up reviews about it from others before paying anything extra for additional goods or services offered by that ATM operator.

As with fiat ATMs, be vigilant of your surroundings when using cryptocurrency ATMs: thieves could still try to take your funds or obtain personal information about you through fraudsters posing as legitimate service providers.

Brief history of Bitcoin ATMs

On October 29, 2013, the inaugural cryptocurrency ATM opened in Canada’s Waves Coffee Shop of Vancouver, British Columbia, featuring a Robocoin machine known as Robocoin. Unfortunately, due to technical errors at Bitstamp, it only operated until 2015 but remains widely recognized as the world’s pioneering Bitcoin ATM. Shortly afterwards, another one opened in Europe – in Bratislava, Slovakia, on December 8, 2013.

Meanwhile, the first Bitcoin ATM ever to be installed in the United States was unveiled on February 18, 2014, in Albuquerque, New Mexico; however, its lifespan was only short-lived and removed after only one month of operating.

As with cryptocurrency itself, Bitcoin ATMs have also experienced challenges regarding regulations. A consensus was finally reached to adhere to all applicable laws and regulations as traditional ATMs do.

Limits include restrictions on how many deposits and withdrawals an individual could make per transaction per day, per account. In the United States, all Bitcoin ATM operators must register with FinCEN as required under the Bank Secrecy Act’s anti-Money Laundering (AML) regulations.

Bitcoin ATMs may need your cell phone number in order to send a text verification code depending on your transaction amount, while before finalizing a deal, they may require scanning government-issued identification such as driver’s licenses as forms of identification.

To their dismay, many crypto enthusiasts have noticed that many Bitcoin ATMs no longer provide anonymity due to regulations that require users to verify their identities before transacting large amounts.

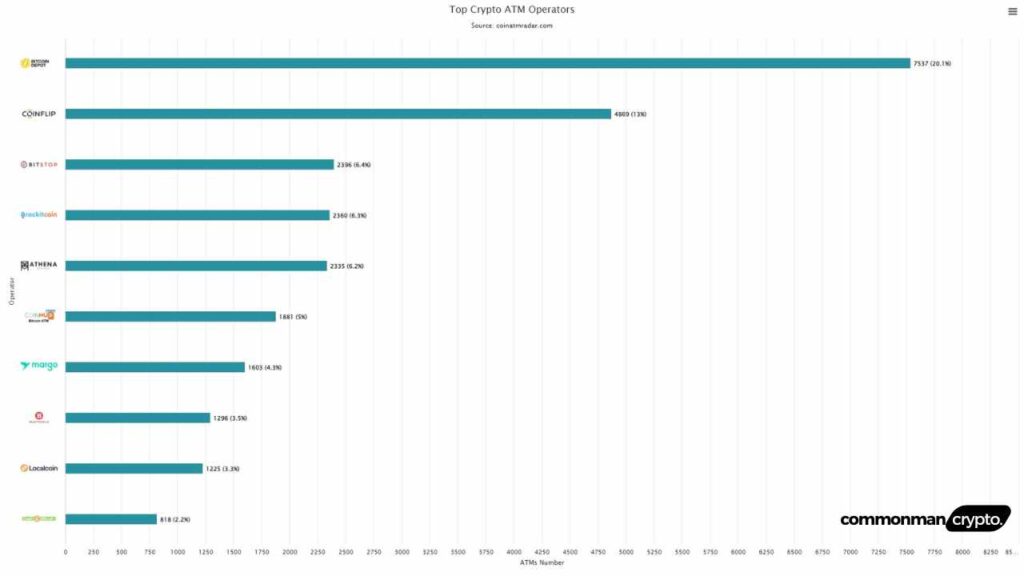

There are currently approximately 28,000 Bitcoin ATMs around the world, with most located in North America – home to almost 90% of the global market share for these machines. Genesis Coin holds 41.55% market share in this space, while General Bytes boasts 35.25%.

BTMs can typically be found in cafes and speciality shops as well as transport hubs like train stations and airports. Business owners who would like a BTM installed within their commercial space typically enter into an agreement with a Bitcoin ATM provider who will handle installing the device on-site.

How does a Bitcoin ATM operate?

Bitcoin ATMs provide convenient purchasing and selling of bitcoin. Most Bitcoin ATMs require users to have an existing account to be able to utilize them.

There are two primary types of Bitcoin ATMs or BTMs.

Unidirectional Machines: One-way transaction machines that facilitate either buying or selling cryptocurrency.

Bi-directional Machines: Two-way machines which facilitate both buying and selling cryptocurrency.

BTMs must be connected to the internet in order to facilitate the exchange of cryptocurrency for cash, typically using public keys on the blockchain or paper receipts as modes of transaction. When transacting large sums, BTMs may require further verification processes.

Unlike ATMs, which facilitate physical deposits and withdrawals of funds, Bitcoin transactions use blockchain-based technologies like smart contracts and QR codes to send cryptocurrency directly into a user’s wallet. Since this type of exchange does not link up directly with bank accounts or large financial institutions, they still abide by similar laws and regulations.

Users will typically be asked to scan a QR code that corresponds with their Bitcoin wallet address, after which purchased coins can be transferred directly into it. A record of their transaction should appear within minutes in their digital wallet.

There are also lower and upper limits on how much cash can be deposited via BTMs in the U.S. All Bitcoin operators are required to register with FinCEN as well as comply with AML clauses of the Bank Secrecy Act (BSA). Depending on your transaction amount, Bitcoin ATMs may require your cell phone number in order to send text verification codes via your cell phone provider. Before concluding your transaction, they may request scanning identification documents such as driver’s licenses for verification.

How to Use a Bitcoin ATM

Below are the standard steps for exchanging fiat currency into Bitcoin via a Bitcoin ATM. In short, here’s how you buy bitcoins using one:

Step 1: Enter Your phone number here

Bitcoin ATMs require identity verification. You will typically be asked for your mobile phone number in order to receive a verification code before proceeding with your transaction.

Once Bitcoin ATMs favoured anonymity, they must comply with Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations today.

Legally, all BTMs must undergo some identity verification procedure, whether scanning a government ID or providing phone numbers for identity checks.

Step 2: Verify Your Identity

Once you submit your phone number, the next step in verifying your identity will be receiving a verification code from BTM via text message and entering that code into the machine you are using.

Your prompt will read: “Your code is 7654321. Thank you,” or similar language. BTM manufacturers included this step to prevent people from inputting false phone numbers into their machines.

Step 3: Scan Your Wallet QR Code

If you use a Bitcoin ATM, chances are high that you already have an address where the BTC will be sent.

Before using a Bitcoin ATM, you will require an active Bitcoin address – this is where it will send actual BTC from the machine. There are various methods of getting one:

Using a paper wallet, an application, or an address in an exchange may all provide suitable ways of holding onto digital coins.

Notably, your QR code represents your Bitcoin address; to communicate that to a Bitcoin ATM and ensure it delivers it as intended. Note that most BTC ATMs support multiple wallets; for more guidance, contact your wallet provider if you are in doubt.

Step 4: Insert Your Fiat Currency Here

Now, all that remains is to enter how much Bitcoin you want to exchange. Much like a regular ATM that accepts deposits, place your cash inside its designated receptacle to trade it for virtual coins.

The machine will then display how much its value in Bitcoins is; for example, insert $400, and you will see the following prompt: $400 USD = 0.0095 BTC.

Step 5: Confirm your amount and complete the transaction

Once you have verified that the correct amount has been entered and are satisfied with your exchange, all it takes to buy or confirm Bitcoins is pressing “BUY” or “CONFIRM.” Your purchased coins will then be delivered directly to the confirmed address with a QR code.

Consider that Bitcoin ATM transactions could take anywhere from ten minutes to an hour to process, as each network confirmation requires six network confirmations before reflecting in your digital wallet. Don’t panic if the amount doesn’t appear instantly!

Selling Bitcoin through ATMs

Depending on the machine, you can either buy Bitcoin, sell it, or both depending on its direction. While buying or selling cryptocurrency can sometimes differ significantly from withdrawing cash with a bank card, the buying/selling experience often remains very similar.

Here are the general instructions when cashing out or selling Bitcoin via an ATM:

- Select your desired option. If you want to cash out, click “Sell BTC.”

- Scan your wallet QR code. You can do this from either your mobile phone app, printed-out pages, or by typing out an address manually.

- Verify Your Identity. While requirements for ID verification vary by country, most BTMs require users to enter their phone number, scan a valid ID document, take photos or even fingerprint scans of themselves in order to use a machine and make purchases involving large amounts of cryptocurrency. Verification should always take place for transactions that involve large sums of BTC.

- Send cryptocurrency directly to an address specified, often by scanning a QR code. Some machines issue cash immediately, while others may ask the receiver to confirm the transaction before issuing any cash.

- Verify the transaction on your end, then wait for the machine to complete it.

- Be sure to save your receipt for future reference.

BTMs make selling Bitcoin easier than ever – these steps outline some basic steps you will be required to take when using one to do so. They tend to be simple and intuitive, so it is best to follow on-screen instructions when inputting information correctly.

Benefits of Utilizing a Bitcoin ATM

Why do people choose crypto ATMs? Here are the benefits BTC ATMs provide over traditional cryptocurrency exchanges.

Convenience

Bitcoin ATMs provide immediate access to cash, making them highly convenient for users. Their instant conversion of digital currencies into cash provides instantaneous relief from traditional exchanges that require linking bank accounts and waiting for fund transfers.

Due to their increasing availability, ATMs can now be found in numerous convenient locations like shopping centres, gas stations, and airports. Operating 24/7 to accommodate users at any time of day reflects the always-on nature of auto-teller machines.

Quick Transactions

One of the standout features of Bitcoin ATMs is their ability to reserve cash in advance for withdrawal, providing fast access when users arrive. Transactions take almost no time at all compared to traditional banking methods, and with their increasing presence worldwide, they offer quick cash transactions and withdrawals at convenient times.

No Bank Account or Identification Required

Small transactions typically do not require identification at Bitcoin ATMs, making them accessible even without bank accounts. This feature is particularly beneficial when conducting low-risk transactions. However, for larger transactions that fall under AML/KYC regulations, such as AML-MSN compliance requirements, users usually verify their identity through phone number verification, which can then be confirmed via SMS text message.

Easy Process

Bitcoin ATMs utilize the familiar format of traditional ATMs to make them more user-friendly, providing an accessible method for users to purchase Bitcoin. Situated strategically and in high-traffic areas, these machines make buying Bitcoin straightforward and accessible – offering potential new investors an entry point into the crypto market without all of its complexities.

Privacy

Bitcoin ATMs provide users who value financial discretion with an attractive avenue for maintaining anonymity in transactions. Users can enhance this aspect by selecting ATMs that don’t require identity verification and using wallets equipped with privacy features, although these offer greater anonymity than online exchanges due to potential security measures like cameras or mobile phone number verification.

Crypto ATMs Risks

While cryptocurrency ATMs provide convenience and accessibility, they do pose some potential dangers.

High Fees

Bitcoin ATMs tend to have higher fees compared to other financial services due to the costs associated with operating physical machines – including hardware maintenance and rental space costs – and providing customer support. Traditional banks typically have lower fees due to more established infrastructures offering wider ranges of services; online crypto exchanges tend to offer lower costs due to large-scale operations reducing overhead expenses while offering reduced blockchain transaction (or gas) fees than ATMs.

Funds Not Insured

One major risk associated with cryptocurrency ATMs is their lack of insurance protection for funds. Unlike traditional banks where deposits are insured, cryptocurrency held in ATMs does not benefit from this coverage, leaving users exposed to security breaches or technical failures, thefts, surveillance cameras and dedicated customer support that could help address issues like transaction errors alone.

Transaction Limits

Bitcoin ATM transaction limits vary, with operators setting predefined or customizable limits depending on customer preferences and needs. Larger transactions often require Know Your Customer (KYC) verification in accordance with anti-money laundering regulations; some ATMs even provide tiered verification levels so users can increase their transaction limits by providing more details or linking a bank account.

Availability

Bitcoin ATMs may be increasing their presence globally, yet remain less accessible than online exchanges for trading Bitcoin. There were only 39,000 ATMs globally as of November 2023 compared to over 10,000 online exchanges providing access to everyone with internet connections for trading Bitcoin at any given moment in time.

How are Crypto ATMs Regulated?

Regulation of cryptocurrency ATMs is a dynamic and ever-evolving component of the financial landscape, affected by international, federal, and state regulations. In the United States, ATM operations are under the auspices of FinCEN, the Financial Crimes Enforcement Network. Operators of money services businesses must comply with the Bank Secrecy Act (BSA), which mandates an anti-money laundering (AML) program with filing Suspicious Activity Reports and Currency Transaction Reports on certain transactions. Furthermore, The Patriot Act further strengthens this framework with stringent Know Your Customer (KYC) procedures that specifically apply to transactions exceeding specified thresholds.

At a state level, operators of crypto ATMs generally must obtain a money transmitter license, adhering to specific state regulations and consumer protection laws, including transparent disclosure of fees and exchange rates and safeguarding consumer data. Furthermore, local ordinances may impact operations by way of zoning restrictions or special operational requirements for their establishments.

International regulatory approaches vary. A notable example is in the U.K., where the Financial Conduct Authority (FCA) recently increased efforts to regulate cryptocurrency ATMs. They have taken significant measures against unregistered crypto ATMs that do not comply with AML standards and other measures that protect customers. This initiative falls in line with their overall policy as all cryptocurrency-related companies must register with them as per U.K. regulation policies that require AML compliance measures and other measures to be met before operating within its borders.

This intricate regulatory tapestry, comprised of both national and international rules, illustrates ongoing efforts to balance innovation in the cryptocurrency sector with financial security concerns and consumer protection needs.

What Are Bitcoin ATM Fees

Are you wondering what the cost of using a Bitcoin ATM is? As we discussed previously, BTM fees remain relatively high even with their increasing popularity, usually ranging between 10-15%. They may go as low as 7% to 25%, depending on where the BTM is placed in its network.

If, for instance, you’re buying $800 worth of bitcoin with an average buy fee of $10 and receiving 720 worth of cryptocurrency in return, your fee would amount to $80 – this represents quite an expensive purchase!

On the other hand, let’s assume you sell $1,000 worth of bitcoin with a 7% sell fee and pay an associated transaction fee of $70; this results in you only receiving $930 of fiat currency and paying $70 as part of this transaction – an amount which could potentially amount to an enormous loss in funds.

One way around this problem is to conduct some preliminary research before going to any machine near you so as to pre-determine which machines have lower fees.

Types of Altcoins Supported by Bitcoin ATMs

Bitcoin ATMs may be known as ATMs, but most actually support transactions involving other altcoins as well. This means you can use them to buy or sell other crypto assets beyond Bitcoin.

Bitcoin ATM technology is still relatively young, hence its limited support of other cryptocurrencies. There are currently 1650+ types of altcoins; therefore, it may take time before all of them are supported by major BTM manufacturers.

However, given the rapid adoption and growth of BTM technology, there is every chance we will continue to see more altcoins supported by global BTM manufacturers.

Frequently Asked Questions

How does Bitcoin ATMs work?

Crypto ATMs differ from traditional ATMs in that they connect directly with digital wallets rather than bank accounts for processing transactions and sending cryptocurrency directly. There are more than 10,000 such machines worldwide, many of them in the US.

Do Bitcoin ATM machines make money?

A: Requirements vary by region and may include AML/KYC compliance as well as specific licenses to operate cryptocurrency businesses. Q: How Do Bitcoin ATMs Generate Revenue? A: Most often, Bitcoin ATMs generate revenue through transaction fees that typically range between 5-10% of each transaction fee collected from its users.

How do I get money from Bitcoin ATM?

Bitcoin ATMs operate differently from conventional ATMs. Instead of providing cash withdrawals and selling Bitcoin directly through them, these machines provide a QR code to which you send your Bitcoin before waiting a couple of minutes and receiving cash in return.

How to deposit money in a Bitcoin ATM?

To deposit cash into a Bitcoin ATM, follow these easy steps: Choose Bitcoin on the machine’s screen; Locate Your Wallet’s QR Code on Its screen and present it for scanning by camera. This will confirm your purchase!

Is Bitcoin ATM safe?

Yes, Bitcoin ATMs are usually safe. When using one, your digital wallet remains safe since only your public key is shared with it, and this allows cryptocurrency to be sent directly into it from that specific wallet.

Who pays for Bitcoin ATMs?

When using a Bitcoin ATM, the fees charged by its operator include an exchange fee – charged as payment for converting cash into Bitcoins and covering costs such as compliance, maintenance and running the ATM itself. This fee covers operational expenses associated with running it successfully.

Conclusion: The Future of Bitcoin ATMs

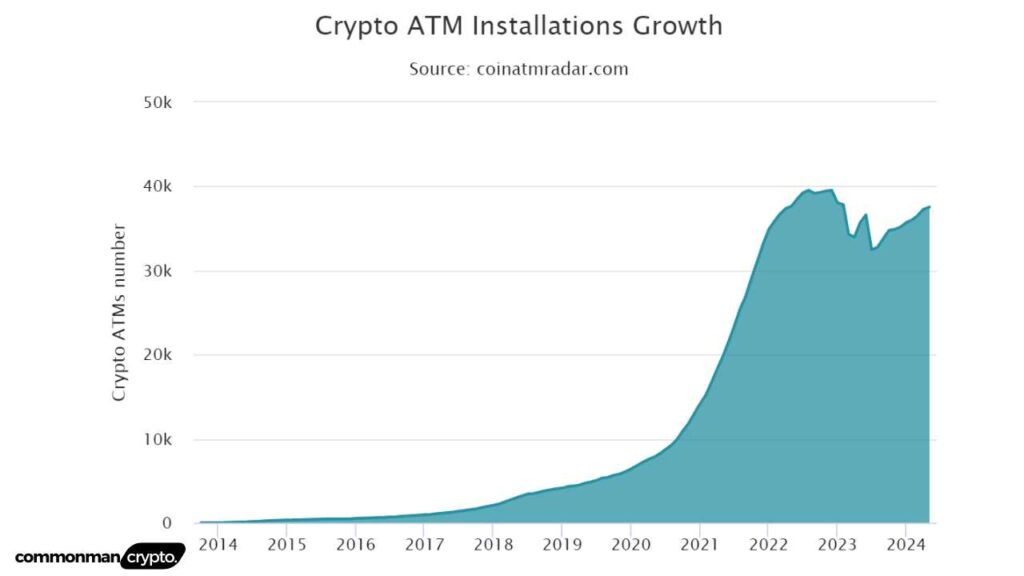

Bitcoin has seen steady appreciation since its debut in 2013. Back then, one Bitcoin was valued at approximately $200; since then, its worth has skyrocketed to thousands of dollars with minimal price fluctuations.

As Bitcoin’s value increased rapidly, so too did its number of ATMs, showing its rising popularity and that of other cryptocurrencies as well.

As the world continues to transition towards digital solutions for everyday transactions, Bitcoin and other cryptocurrencies should grow increasingly popular.

Since Satoshi Nakamoto first mined Bitcoin, it has remained a completely independent online currency unhindered by regulatory bodies or large financial institutions.

As such, many global leaders, financial elites, and economists have voiced suspicion over Bitcoin since its creation. Yet, thanks to Nakamoto’s near-perfect code, its blockchain has never been compromised since its introduction into circulation.

Although no guarantee can be given of Bitcoin blockchain’s impregnability indefinitely, investors and enthusiasts remain confident in its continued security and success.

As such, Bitcoin ATMs are widely expected to continue growing in both popularity and number in the coming years. People find them convenient because they offer easy and secure cryptocurrency purchases without incurring high transaction fees; unfortunately, this technology still has flaws that must be overcome for it to remain relevant; nonetheless, it gives people access to secure cryptocurrency purchases via ATMs.

If you plan to buy or sell Bitcoin through an ATM, remember to consult online resources so as to determine which machines offer the lowest fees and input all necessary details, such as digital wallet information, correctly – errors caused by inputting incorrect details can often not be undone by subsequent transactions.

We hope that this article has provided you with all of the essential knowledge about Bitcoin Teller Machines. Feel free to check our homepage often for updated rates, news, and information regarding various cryptocurrencies.